Is Covid Hitting Your Finances Hard? Here’re 4 Things You Need To Do Right Now!

This month (March 2021) marks exactly one year since Singapore went into our first lockdown state because of Covid-19. One year on, we have since learned to co-live with Covid-19 as we get back to our everyday lives.

But life has not been the same since the Covid-19 outbreak. One part of our lives that has been hit particularly hard is our finances. Some of us have lost our jobs while others have been asked to take a pay cut. If you are one of those who have seen your finances hit hard by Covid-19, here are 4 things which you need to do right now to improve your finances.

-

Switch Out Of Your Expensive Utilities, Telco Plan

Living in the 21st century, there are some things that consumers like you and I do which really baffles us. One of them is the stubbornness to stick with habits of the old, i.e. continuing to pay SP services for your utilities and sticking to outdated and expensive telco contracts.

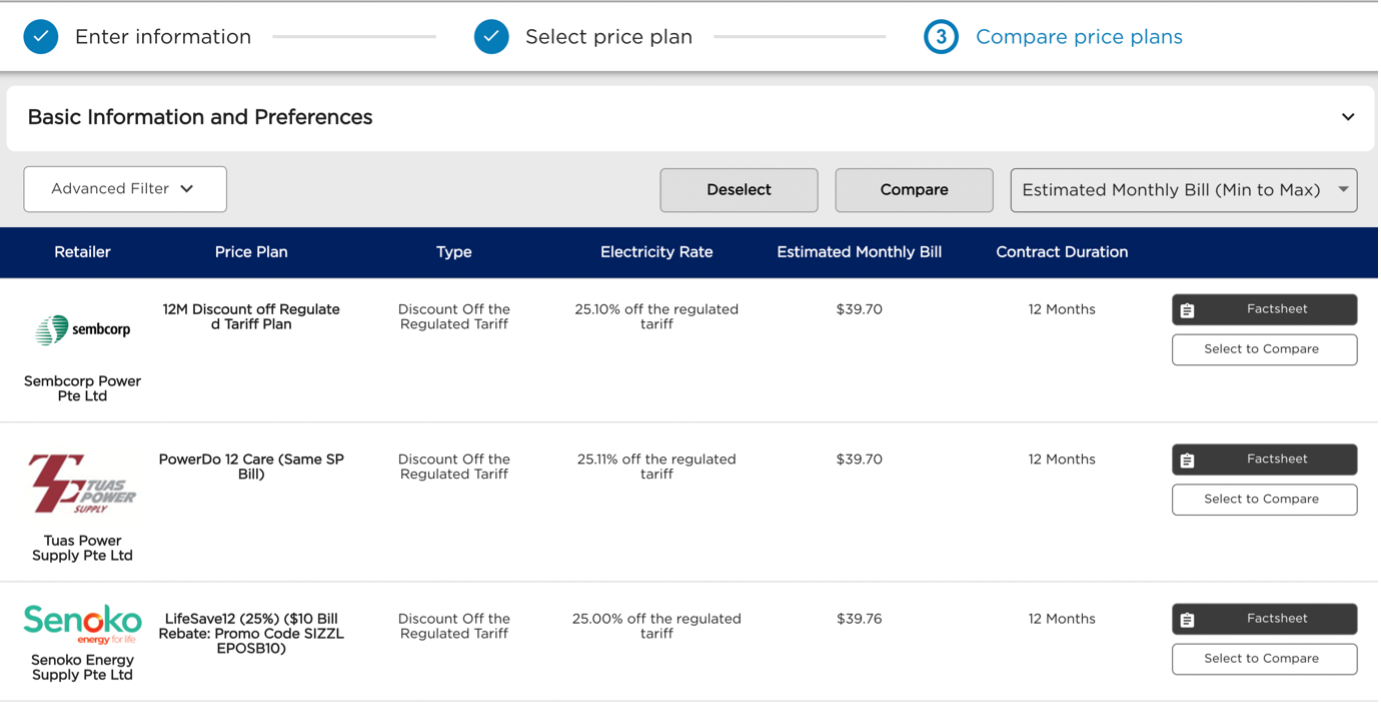

With the move towards an open electricity market, you have 14 different electricity providers that you can switch to. And by switching to any of these electricity providers, it will bring your electricity bill down by 20-25% compared to SP services. You not only have the option of choosing 6-month, 12-month or 24-month contracts, you can also choose from fixed or discounted price plans. Plus, some of the electricity providers are even partnering with credit cards to give you additional cashback for more savings.

For telco plans, you now have the option of opting for contract-less SIM-only plans that will be 30-50% cheaper than your usual contract plans. These SIM-only plans are not only cheaper, sometimes they provide you with even more call minutes and/or data.

-

Unsubscribe From Unnecessary Subscription Services

Subscriptions like YouTube premium, Spotify premium and Netflix will cost you ONLY $10 to $20 a month. By sharing with your friends, it will bring the cost down to few dollars a month. That’s cheap, isn’t it?

Well, that’s what these services want to make you think. It is now so cheap to subscribe to these services that you don’t even think about it when you subscribe. You subsequently forget about them as time goes by. Soon, you find yourself subscribing to a ton of these “cheap” subscription services and end up with a monthly bill of few hundred dollars every month.

While we do think that these services are cheap, make sure you don’t subscribe for them just because it is cheap. Make sure that you are making full use of the service you subscribe. If you aren’t, then unsubscribe from it.

-

Stop Paying Unnecessary Interest On Your Home Loan

Another unnecessary expense that Singaporeans tend to unknowingly waste your monthly budget on is your home loan. To be exact, it is the extra interest payment that you are paying on your home loan.

Over the years, interest rates on home loan has been dwindling. Today, the cheapest home loan rate is only slightly more than 1% (1.08% to be exact). However, some of us are still sticking to HDB loan for your HDB flat that is charging you 2.6%. For others, it might have been years since you refinanced and your home loan interest rate might be around 1.5%.

For a home loan of $400,000, here is how much you would be paying for your monthly instalment:

| Interest Rate |

Monthly Mortgage |

Savings |

| 2.6% |

$2,139.15 |

– |

| 1.5% |

$1,930.18 |

$2,507.64 per annum (vs 2.6% interest rate) |

| 1.08% |

$1,853.89 |

$915.48 per annum (vs 1.5% interest rate)

$3,423.12 per annum (vs 2.6% interest rate) |

Why waste the opportunity to save a few thousand dollars every year without much heavy lifting? You can even engage Moneyline.sg to help you source for the best home loan deal to save even more! Contact us today to compare the best home loan refinance rate for you to get you more savings!

-

Make Your Money Work Harder For You

Saving and stretching your dollar is just one part of the equation. That’s because there is a limit to how much you can stretch your finances. The more sustainable way of ensuring that your finances is healthy and able to pay off your monthly commitments is to increase your income.

Side hustles and getting better at your job to ask for a pay raise are some of the ways you can increase your income. Another way is to make your money work hard for you by doing some smart investing with your money.

For instance, instead of putting your money in the bank account to earn that meagre 0.05% interest rate per annum, you can put it into savings product that can earn you a higher interest rate. Endowment savings plan and traded endowments are some of the safe ways that you can earn more interest while still keeping your money safe. For those with higher risk appetite, you can consider investment products like investment-link policies (ILP) where you can be rewarded for investing in more risky assets.