How Much Do I Need To Retire in Singapore?

Completing tertiary education, getting your first job, getting married, having children, and then retirement. These are the five phases of life that most Singaporeans go through. For many of us, we have been there and done that for 3 or 4 of these life phases. You may be reading this now because you may be preparing towards the final phase in your life: Retirement. So how much do one need to save for retirement to be able to retire comfortably in Singapore?

Before we conclude with a realistic assumption, here are some key questions you can ask yourself first:

-

Retire at What Age?

The first question is “when?”, i.e., when do you want to start your retirement? And knowing the age when you want to start your retirement has two implications.

First, it will give you an estimation of how much retirement savings you need. For instance, if you want to retire at age 55 and your life expectancy is 85, you need to have 30 years’ worth of adequate saving in order to retire, assuming you live through them.

Second, it will tell you how much more time you have left before it starts. If you decide to retire at 55, then the years between now, if you’re 30 years old for example, indicates you have another 25 years to accumulate your retirement war chest.

-

Lifestyle Needs During Retirement

What type of lifestyle are you looking to lead during retirement? A group of professors from our local universities has recently done a survey, they found that in general, a single retiree today needs around $1,379 each month in order to afford basic necessities.

When it comes to the list of basic necessities, left out of that list were air-conditioning at home and a car. One may potentially need an additional $1,000 or more a month in order to sustain that privileged lifestyle.

For some, retirement means a complete step down from the working life. You no longer want to be working and you prefer to spend your retirement days focusing on doing voluntary work, engage in a hobby, or just travelling around the world to experience life. For that, a minimum sum may not be enough unless you have sufficient cushion set aside elsewhere other than in your CPF.

For others, retirement is just a phase where you take things slow. While you still want to be actively engaged in your job, you may want to do it at a slower pace.

Essentially, here are some factors to consider:

- Whether you want to own a private vehicle or travel via public transport;

- How often you will be travelling overseas;

- Expectations for standard of living (e.g. Dining in at restaurant, eating out at coffeeshop/hawker centre)

It’s always good to plan ahead and to factor in such cost for the time to come.

-

Where do you wish to Retire?

Where do you want to spend the rest of your life at?

The choice of where to spend your retirement is not just a question of aspiration. It is also a question of environmental and economic safety, where you feel most at home, and how much it will cost. This could also be a backup plan because a basic needs for retirement in Singapore could be an extravagant lifestyle in other countries. Indeed, if you could, don’t you wish to spend your retirement in a nice beach resort while sipping champagne? Then there is of course the need to be close to your love ones which may outweigh that aspiration.

That being said, the choice of your country or city to retire can affect your retirement planning. Example, if you were to retire in Johor Bahru or Batam, the cost of living there may be less than half of Singapore’s. If you’re living on CPF Life minimum sum in these places, it may qualify you for a very comfortable lifestyle while you may compromise other aspects such as safety and political stability.

Inversely, there are also more expensive places to retire. A favorite among retirees is Australia where you get to live in the suburbs and enjoy the tranquility. According to Australia’s Retirement Standard, you may need 30k AUD to retire in Australia. That is almost twice the amount you need in Singapore for basic necessities, and don’t forget you will have to set aside extra monies on accommodation in a foreign land!

-

Retirement With CPF

Can you just rely on your CPF for retirement? Of course, it depends.

With CPF Life

After all, you can start receiving your CPF LIFE pay out from age 65 onwards but it is anyone’s guess that it will stay at age 65 forever.

Assuming status quo many years down the road, if you are just relying on your CPF life for retirement, hitting the Full Retirement Sum (FRS) may mean that you are only able to supplement basic necessities.

If CPF Life is your YOLO option at 65, then consider setting aside the Enhanced Retirement Sum (ERS) to live a more comfortable life as you receive more money from your CPF Life. E.g., if you set aside ERS now at 55, you should be able to receive roughly $2,000/mth from 65 years old onwards.

With ERS at $279,000 this year (2021), forward that 10 years later, based on a 3% p.a. compounded growth rate you will need to set aside roughly $375,000 in your Retirement Account to hit ERS and with that, you may receive and estimated monthly income of $2,700 from 65 years old onward.

This is all assuming you are to retire at age 65 and assuming no changes to CPF policies by then.

Withdrawing My CPF at 55 Years Old

The way to do this is to maximise your CPF Special Account to the minimum Sum as early on as possible in your life and consider paying cash for your housing loan instead of paying through your CPF OA.

Let’s assume you are able to and your aim is to retire by 55 with 600,000 in your CPF account 10 years later. Setting aside $375,000 for your ERS to receive a monthly income of $2,700/month you will still have $225,000 left in your OA/SA. As such, you may drawdown a monthly income of $2,000 for from 55 – 64 and let CPF Life fund the remaining years of your life afterwards (assuming CPF Life still pays out from 65).

You may also invest your OA to achieve potentially higher return by age 55 considering CPF OA is only giving 2.5% p.a. A well-diversified investment may potentially achieve stable and higher returns. We have all heard 1M65 have you tried 1M55? It’s possible, but at your own risk.

-

The Right Retirement Amount

What is the right amount to save for retirement? We have a simple answer for you and this is subjective to the type of lifestyle you may have or are already having right now. Basically, we feel that the monthly amount on average you spend on yourself between age 40 – 45 will be the exact same amount you should plan for during retirement. Think about it, at this age you are likely to be at the peak of your career, your kids are a little more independent now (if you have any) and it may be where your lifestyle expenditure skyrockets. Example, if your monthly household expense totals up to $6,000/mth between 40 – 45, then you should prepare to have that amount for your retirement each month. By simple math with a requirement to retire with $6,000 monthly from 60 years old till age 85, you will need

$6,000/mth x 12 x 25 = $1,800,000!

Complimenting your retirement with CPF

Don’t worry you may already be half way there. If you and your spouse are confident to hit your FRS by the time you both are 55, thenit may be easier. You just have to factor the gap between 60 – 65 and make up the difference between your CPF life pay out and your expenditure from age 65 onwards.

Wait, did you just brush off inflation?

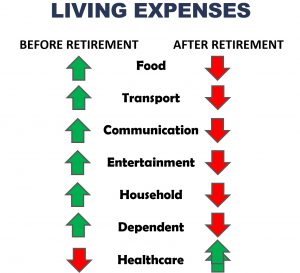

Yes, we did. In fact, the amount you spend during retirement on yourself should be lesser than your peak lifestyle during 40 – 45. Hence if we were to look at it from a cost perspective, this is what it should look like for your living expenses before and after retirement.

And no, we did not just pluck this assumption out of thin air. According to a Consumer Expenditure survey done in 2014, suggesting that retirees should plan for constant inflation-adjusted expenditure may overestimate the required retirement savings that many couples or individual will require for a successful retirement. The findings shows that the average annual household expenditures for a person age between 55 – 74 will spend on average 16% to 34% lesser than a household between 45 to 54 years of age, and this follows a trend whereby a person aged 75 and older spent 25% less than the age group between 65 – 74.

Hence, we may realistically assume that while inflation is guaranteed, your cost of living should also decrease as you age. The decrease in expenditure should eventually weed out the rising inflation as the year goes by.

Do you agree with us?

Our MAS-Licensed Partner will provide you with objective advice and help you compare insurance quotes from different providers. 100% Free & No Commitment. Retrieve your info using your Singpass App or Manually fill in the forms below.

6 Comments