Fixed Deposit vs T-Bills vs Singapore Saving Bonds: Who Is The Most Attractive Among Them?

Mirror mirror on the wall, who’s the prettiest of them all? Nope, we are not asking about Snow White. Rather, we are asking the magic mirror which is the most attractive to invest in between Fixed Deposit (FD), Singapore Treasury Bills (T-bill), or the Singapore Saving Bonds (SSBs).

For many Singaporeans out there who have spare cash in your pocket to itching to earn some bond yields, this is a million dollar question that you need answer to. That’s why we are here to help you answer that.

Investing Your CPF Money In FD/Bond

CPFIS: Who Can Invest Their CPF Money?

Did you know that if you have more than $20,000 in your CPF Ordinary Account (OA) and/or $40,000 in your CPF Special Account (SA), you have the option of investing it? Yes, you are not just limited to the 2.5% interest rate that CPF OA offers.

Under the CPF Investment Scheme (CPFIS), you can invest your CPF OA in other investment products that fall under the following:

Source: CPF

Why Are We Considering FD/Bond?

Among the list of investment products that you can invest in, the ones that we are interested in are the bonds. That’s because bonds around the world are yielding at its highest rate in the past two decades.

Which Is The Most Attractive In Terms Of Yield?

For SSBs, you can earn an annual interest rate of ~3% p.a. This is set by the Monetary Authority of Singapore (MAS) so it is fixed once it is decided. You can choose whether or not to apply for it, depending on whether you like the yield on offer.

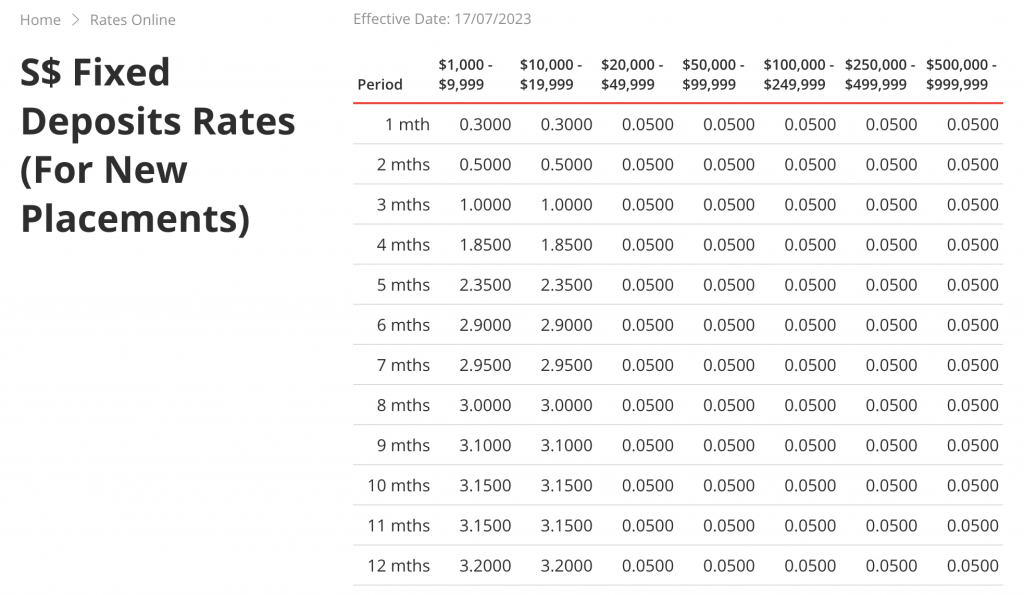

For FDs with banks, you can earn between 3.05% to 3.75% p.a., depending on how much capital you have and how long you are depositing it for. For instance, Maybank is offering 3.75% p.a. for its 12-month FD if you deposit a minimum of $20,000. Similar to SSBs, it is fixed and can’t be negotiated with. If you don’t like what’s on offer at the bank, you can choose not to open an FD with them.

For T-bills, the situation is slightly different. Every 2-3 weeks, there’s a new T-bill auction that takes place. You can choose to put in a competitive bid on how much yield you are willing to accept to lend your money to MAS. For example, you can choose to bid at a yield of 4% p.a. on the upcoming 6-month T-bill auction. MAS will then collate all the bids and decide what’s the cut-off yield for each round of auction.

At the moment, yield on T-bill is trending at around 4% p.a.

From a yield standpoint, T-bill is the most attractive among all three type of investments you can invest in.

Why Would You Consider Other FD/Bond If T-Bill Is The Highest Yield?

Yields on all three types of investments can change. The imminent change also means that T-bill may be the most attractive right now, but it may become much less attractive in 6-12 months down the road.

The other concern with T-bill is the hassle that comes with it. Because T-bill comes in 6-month or 12-month time period, you need to monitor your T-bill maturity diligently. If your T-bill matures, then it comes back into your CPF OA/SA. There’s no mechanism to remind you to apply for a new T-bill.

In addition, when your T-bill matures in 6-12 months, the interest rate outlook might be drastically different from now. This can affect the yield that you will earn on your T-bill when you are applying for a new set of T-bill.

Putting your CPF money in FD or SSB means that the yield is guaranteed for a much longer period. There is no reinvestment risk involved, unlike T-bill. For the uninitiated, reinvestment risk means that, when you are about to reinvest your money again, you can’t get a similar yield as what you had gotten earlier.

What About Investing Your Spare Cash?

What if you have spare cash lying idle that you want to invest with? Should you also go for FDs, SSBs, or T-bills? Well, with cash, you have much more investment options.

You Can Invest In Foreign Currency Fixed Deposit

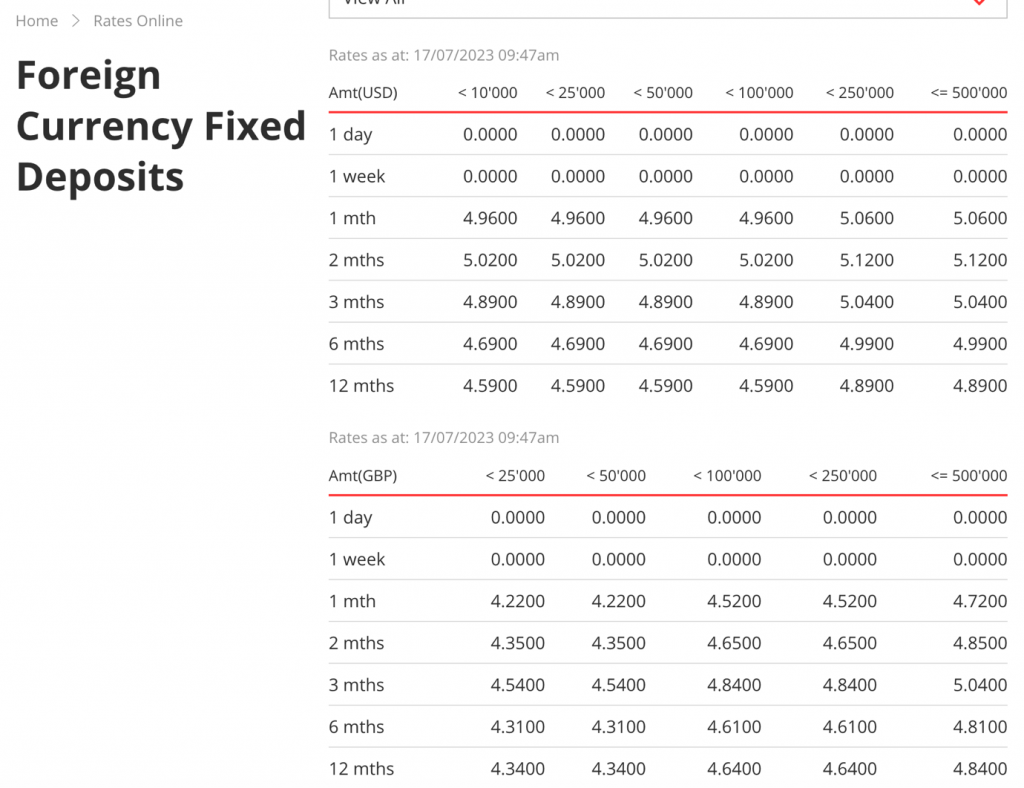

For CPF money, you can only invest in Singapore Dollar denominated FDs. But if you have cash, you can invest it in a foreign currency FD.

Source: DBS

If you invest in an SGD FD, an investment just below $20,000 will only get your 3.2% p.a. for a 12-month period.

Source: DBS

For the same investment amount, you can earn 4.59% p.a. for a 12-month. (Note: S$20,000 translates to around US$15,000). Yield wise, the foreign currency FD will be 43% higher (3.2% vs 4.59% p.a.).

You Can Invest In Stocks

If we look at the average stock market performance of Straits Times Index (STI) in the last 10 years, it is 3.41% p.a. If we look at just the last 3 years, it more than triples to 11.18% p.a. Compared to the yield on FDs/bonds, it does pale in comparison.

Make Sure You Aren’t Losing Sleep Over Your Investments

Be it whether you are more of an FD, SSB, or T-bill person, the most important rule of thumb to remember is that you shouldn’t be losing sleep over your investments at night. Make sure that your choice of investment complements your risk appetite and risk tolerance.

Not sure how big your risk appetite is? Get a free risk appetite assessment with Moneyline.sg to help you make the right investment decisions.