eTiQa Essential Critical Secure: A Hybrid Critical Illness Plan To Safeguard Your Critical Illness Risks

Critical illness (CI) is one of the most dangerous health problem one might face in our lifetime. The biggest danger is not that it is incurable, but because there is a massive protection gap of 74%, according to a Life Insurance Association (LIA) Protection Gap Study in 2022.

A 74% protection gap means that there is a 74% shortfall in money needed for treatment and recovery upon being diagnosed with CI.

To address such a protection gap, eTiQa recently launched its Essential Critical Secure, a Critical Illness plan that brings with it mental health support and continuous financial care.

Here are five reasons why eTiQa Essential Critical Secure can provide the right safeguards against your CI risks.

5 Reasons Why eTiQa Essential Critical Secure Provides The Right Safeguards For Your Critical Illness Risks

-

CI Coverage For 104 Medical Conditions (Early, Intermediate, And Late Stages)

Let’s first start with the basics. The foundation of any CI plan is its coverage against the event of getting diagnosed for CI.

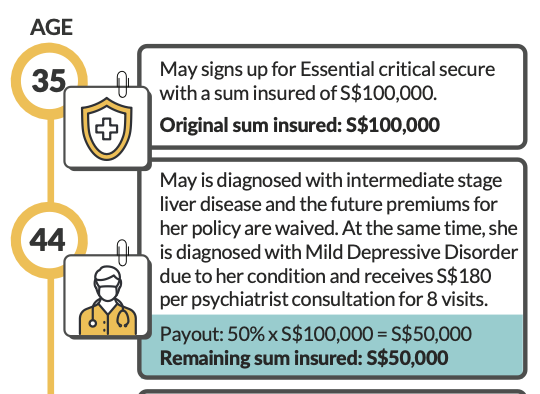

With eTiQa Essential Critical Secure, you can are covered against 104 different medical conditions across early, intermediate, and late stages. The payout depends on the stage of diagnosis for the medical condition.

If you were diagnosed for CI in the early or intermediate stages, you will receive 50% of the sum insured on eTiQa Essential Critical Secure. This will be paid out at the point of diagnosis.

If (unfortunately) you were diagnosed for CI in the late stages, the payout will be 100% of the sum insured.

Source: eTiQa

Source: eTiQa

-

Early/Intermediate CI Coverage: Remaining Sum Insured Still Claimable

As mentioned above, upon diagnosis of early or intermediate CI, you will be able to claim for 50% of the sum insured. Then what happens to the remaining 50%?

Under eTiQa Essential Critical Secure, the remaining 50% is still claimable under two scenarios:

- Diagnosed for another CI in the early or intermediate stage

- Condition for the initial early/intermediate CI worsens into a late stage CI

This feature makes ETiQa Essential Critical Secure stand out as one of the more unique CI plans in the market. It is one of the few “hybrid” CI plan that covers both early/intermediate and late stage CI in a single plan.

-

Continuous Care Benefit: First In The Market

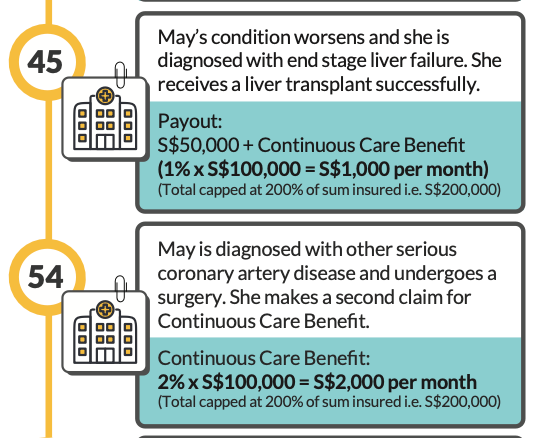

Another interesting protection feature that ETiQa Essential Critical Secure provides is the Continuous Care Benefit. Should you be diagnosed with late stage CI among one of the 36 severe stage CIs, there will be an added monthly cash payout.

The monthly cash payout is equivalent to 1% of the sum insured. This will be paid out continuously until it 200% of the sum insured hits. There will be at least five years of Continuous Care Benefit even when the live insured (e.g. you) passes on.

In addition, should one be diagnosed with multiple late stage CI that falls under the 36 severe stage CIs, a second claim against the Continuous Care Benefit can be made. If one is diagnosed with 3 out of 36 severe stage CIs, the monthly cash payout will be 3 x 1% of the sum insured. It will be paid out all the way till 200% of the sum insured hits.

Source: eTiQa

-

Growing Awareness For Mental Health Support: Financial Support For Mental Health

With the rising prevalence of mental health, the need for mental health coverage is growing in importance. Therefore, eTiQa is making it a point to institute financial support for mental health in its Essential Critical Secure.

For mild mental health conditions, there will be a payout of $180 for each psychiatrist consultation. One can make up to eight claims upon diagnosis of Mild Depression or Generalised Anxiety Disorder. Note that this can only be claimed from the second policy year onwards, not in the first policy year.

On top of that, eTiQa Essential Critical Secure also provides coverage for severe mental health conditions. There are five severe mental health conditions covered by eTiQa. Upon diagnosis in any one of the five severe mental health conditions, 20% of the sum insured will be paid out.

-

Adjusted Affordability With Flexible Coverage Duration

eTiQa Essential Critical Secure comes with coverage term for up to ages 70, 75, 80, 85, 90, 95, and 100. The purpose of having such a flexible coverage duration is so that you get to choose the one that suit your CI coverage needs.

As we know, affordability is a key concern for CI plans. Thus, if affordability is a concern for you, you can choose a younger age for coverage term. This will shorten the years for premium payment but yet keep you protected against 104 different medical conditions of all stages.

On the flipside, if you want to opt for more comprehensive CI coverage, you can still do so by choosing an older age for coverage term.

Is eTiQa Essential Critical Secure The Right Critical Illness Plan For My Protection Needs?

eTiQa Essential Critical Secure brings with it interesting features to consider for CI protection needs. Still, the big question is whether it brings the right kind of CI protection for you.

In order to assess this, the most objective way is to get a comprehensive review of your protection plans with a trusted financial advisor. With an overview of your existing plans, your trusted financial advisor will then be able to advise whether eTiQa Essential Critical Secure is the right one for you.

LIA recently recommended 4x of your annual income to be covered for in the event of critical illness.

If you need a trusted financial advisor to help you, reach out to us so that we can do a comprehensive financial planning analysis for you. This will help you to better understand where eTiQa Essential Critical Secure cover the gaps you have in your existing financial plan.