Buying A Property Soon? Make Sure You Know The Bala Curve. Here’s Why

Ever heard from your friends or property agents telling you that your leasehold property will become “worthless” after 99 years? Well, there might be some basis for such claims. And if you are planning to buy your own property soon, you need to educate yourself with the Bala Curve.

Bala Curve: What’s That?

Bala Table, Bala Curve and SLA Leasehold Table. These are just name variations of the same thing: Bala Curve. The Bala Curve was said to be prepared by a Land Office employee by the name of Bala back when Singapore was still a British Colony.

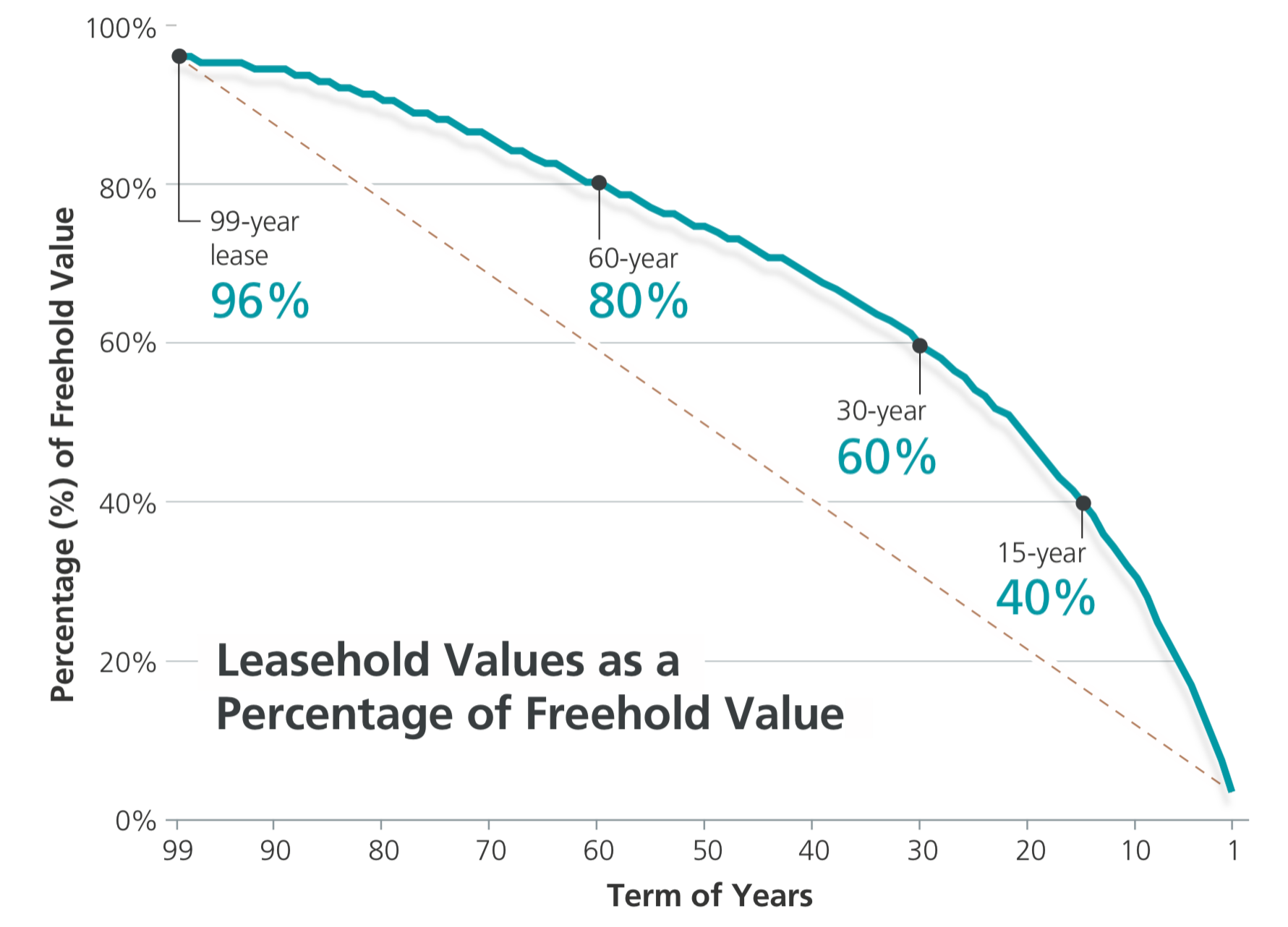

According to the Bala Curve, every 99-year leasehold land in Singapore is pegged to 96% of the freehold land’s value. As the lease starts to be used up, the value of the land as a percentage of the freehold land decreases.

3 Key Things You Need To Know About Bala Curve If You Own An HDB

But knowing about the Bala Curve is not enough. There are a few key characteristics you need to know about the Bala Curve. These characteristics will help you make better property decisions such as (i) the right time to sell your property; (ii) whether you are overpaying for your shortlisted property.

-

Key Intervals On The Bala Curve

If you observe the Bala Curve carefully, you will notice that there are three key intervals: 60-year, 30-year and 15-year mark. The reason why these three intervals are important is that the rate of decline in the value of leasehold properties increases with each interval.

For example, between 99-year and 60-year, the fall in value of your property is 0.1 to 0.4 basis points (bp) for each year of lease. Between 60-year and 30-year, the decline in property value is 0.5 to 1.0 bp for each year of lease. From 30-year to 15-year lease, the decline is even more prominent, i.e. 1.0 to 1.8 bp. Once it hits the 15-year lease mark, the decline is much more accelerated. It can fall between 1.8 to 3.8 bp.

Thus, if you are thinking of selling your property to encash your property gains, the best period to do it is when your property has not passed the 60-year lease mark.

-

A Reference Point For LBS And VERS

But not everyone intends to sell their property. Sometimes, you feel so comfortable with your property that you wish to stay in it till the end of your time on Earth and enjoy your retirement years in it.

And as you enter into your retirement years, you might be looking to encash some of your property’s value to fund your retirement lifestyle. If that’s you, then you should know that the Bala Curve is used as a reference point for the Lease Buyback Scheme (LBS). We also expect it to be used in the upcoming Voluntary Enbloc Redevelopment Scheme (VERS), albeit with a higher value than what one would expect from the Bala Curve.

Knowing this about the Bala Curve can help you better plan for your retirement, especially if you are looking to supplement your retirement fund with some proceeds from your property.

-

Bala Curve Is Not An Absolute Rule

Before you go about thinking that the Bala Curve is the ultimate truth, bear in mind that it isn’t. While it is used as a guideline, there are certain circumstances where it might not apply.

For instance, when property developers want to enbloc private properties to replenish their land bank, they might be willing to pay a premium above what the Bala Curve implies. For HDBs, there can also be buyers who are more than willing to pay above what the Bala Curve implies for a unit in a good location with a good city/fireworks view.

Want To Make Smarter Property Decisions? Start With Your Home Loan!

Now that you have learnt about the Bala Curve, you know how the value of your property changes with age. It can help you make a better decision on when is the right time to sell. Speaking of the better decision, there’s another smart thing you can do for your property: Choosing the right home loan.

The right home loan can help you to save a few hundred dollars off your mortgage repayment every month. Worried about the effort involved in switching out of your existing home loan? Don’t worry because you can approach Moneyline team to get our home loan specialists to find the best home loan deal for you.

2 Comments