4 Services That Homebuyers Should Know Before Buying Your First HDB

Buying your first HDB is a milestone in life that many Singaporeans wish to achieve. But like every other milestone in life, achieving it is not as straightforward as it seems. There are plenty of things to consider and fire hoops to jump through before you can successfully buy your first HDB without making any rookie mistakes.

Don’t you wish that there is some guide that can give you some guidance on getting your first HDB so that you make a better and smarter decision that you won’t regret? Well, that’s why we created this guide to share with you 4 services that you should consider when you are looking to buy your first HDB.

1. HDB Flat Portal – New HDB Tool For HDB Homebuyers

In January 2021, HDB launched its new platform that helps homebuyers streamline the whole process of buying and selling your dream home. The platform, known as HDB flat portal, provides a range of services that homebuyers will need in the homebuying process:

The platform, known as HDB flat portal, provides a range of services that homebuyers will need in the homebuying process:

Planning your finances is an important step when it comes to buying your first home. HDB advocates that and that’s why they place the financial calculators on the HDB flat portal so that it is the first thing you consider before you shortlist for your HDB flat.

If you are a buyer or seller of an HDB flat, then you need to know the HDB resale portal. The HDB resale portal not only helps you to check the eligibility for buying/selling of resale flats, but it also guides you step-by-step on what needs to be done when you buy or sell a resale flat.

Homebuyers who are looking to take up an HDB loan will need to apply for a Home Loan Eligibility (HLE) letter. This letter confirms whether you are eligible for a home loan from HDB and the loan quantum you can get from HDB.

2. Hausanalyst – Digital Twinning To Help You Shortlist BTO Units

For most homebuyers, buying a BTO is like buying lottery. You have limited information about the unit that you are paying for. It is only until 4-5 years later before you know whether the BTO unit that you have chosen is one that was worth paying for. It is no wonder why more and more homeowners are switching to resale flats instead of BTOs.

But what if there is a service that lets you visualise the BTO project in 3D view for you to analyse so that you can shortlist the right units? Well, that’s what Hausanalyst is providing for homeowners.

Using his years of experience as an architect, Hausanalyst is able to create 3D models of BTO projects that look exactly like the ones you will find inside HDB Hub using a technique known as digital twinning. In fact, the model that is built by HDB and displayed in HDB Hub is first digitally created using digital twinning before converting it into a physical 3D model.

Hausanlyst digital twinning allows you to do multiple analysis like:

- Sun simulation analysis

- Wind simulation analysis

- View analysis

Hausanlyst runs computer simulation on the BTO project to help you identify which BTO unit will enjoy better wind and avoid the much-hated west sun.

Not just that, you can even visualise the view from within the exact unit that you want to shortlist, rather than leaving it down to luck.

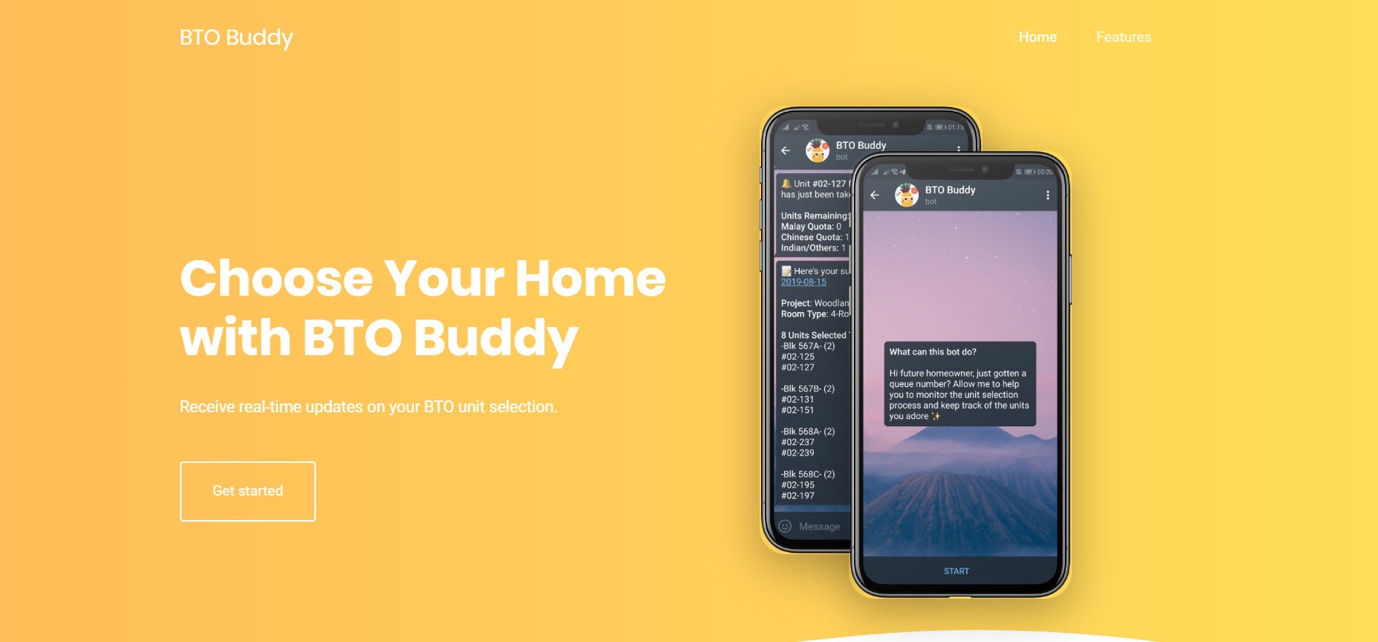

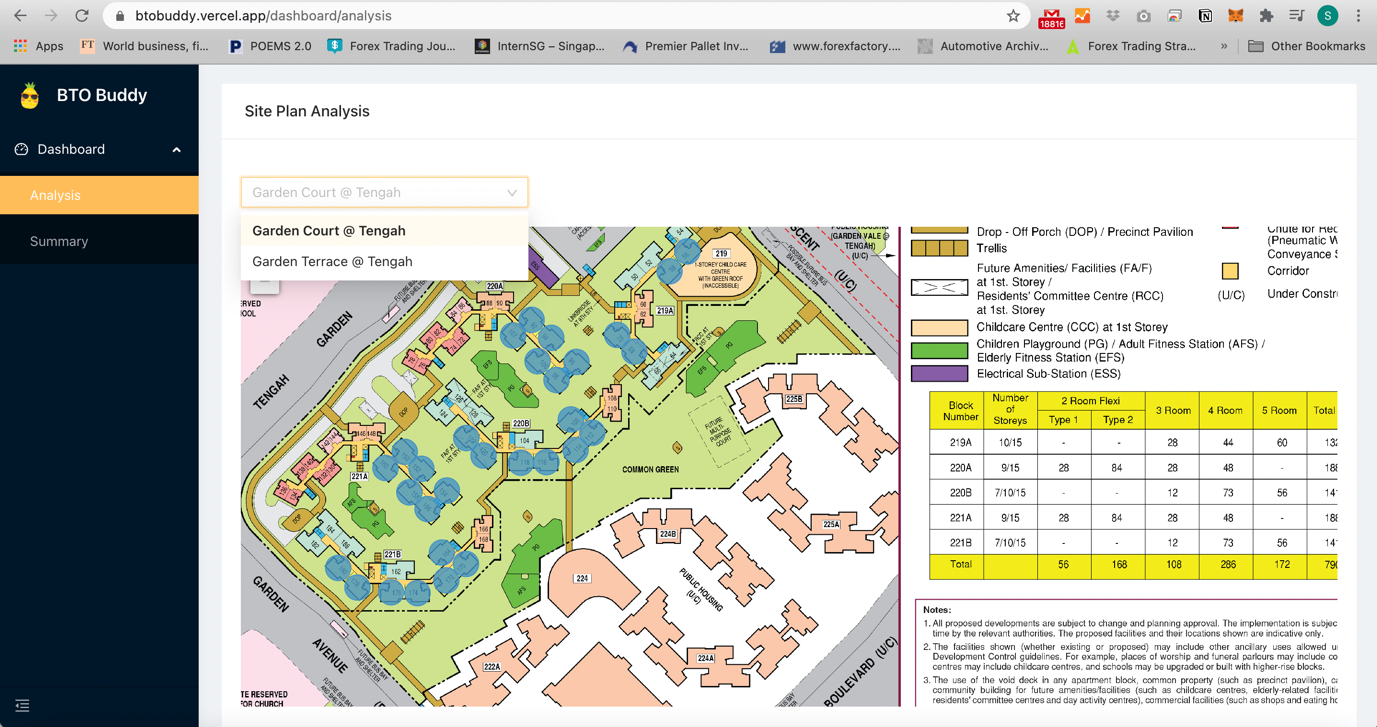

3. BTO Buddy – Watchlist Your Shortlisted BTO Units

Those who are buying BTOs should know this: HDB BTO has a unique ballot and queue system. If you are high up in the queue, you can pick any of the available BTO units. However, if you are low down in the queue, you can only choose the BTO units from the remaining ones.

As such, the BTO unit that you have had your eye on might not be available by the time you go down to HDB Hub to make your selection. The worse thing is, there’s no way to know what BTO units are still available until it is your turn to choose at HDB Hub.

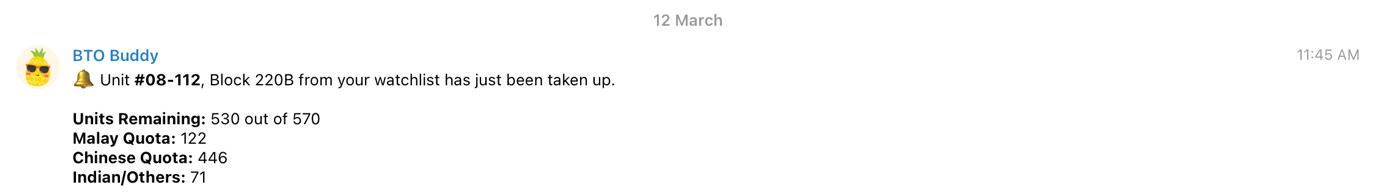

But that’s all in the past. Today, you have services like the BTO Buddy which helps you monitor and keep track of the remaining available BTO units. It even helps you to watchlist the ones that you have shortlisted.

Whenever any of them gets taken up, you will receive a notification on your Telegram. You will also get daily updates of the remaining units and the different ethnic quota.

4. Moneyline.SG Home Loan Comparison – Planning Your Finances For Your BTO

Planning your finances for your BTO is a key step that we cannot emphasise enough. That’s because not planning your finances well for your BTO is akin to financial suicide. You will not only overstretch yourself, it can also cause you to pay for unnecessary interest rate payment when you take on home loans with high interest rates.

One of the classic example of this is when homeowners opt for HDB loan instead of home loan from banks. For the uninitiated, HDB loan charges a 2.6% interest rate whereas bank loans charge only 1.0-1.1% interest nowadays. There’s a huge difference in terms of the monthly mortgage repayment for these two interest rates: $2,673.94 (HDB loan) vs $2,321.85 (bank loan) for a $500,000 BTO. This means that you are overpaying $4,225.08 more every year by opting for the HDB loan instead of the cheaper bank loan.

We know the pain of getting stuck with a huge financial decision like this because we have been in that situation before. We know that buying your first BTO can be a complex and difficult task where you have to juggle so many things at one go. That’s why we started Moneyline to help new homeowners better plan your finances to avoid making rookie mistakes like this.

At Moneyline.sg, we not only engage you to better understand your home loan needs and help you plan your finances, but we also help you compare and find the best home loan deal for your BTO.

4 Comments