Best USD Lifeincome Plan in Singapore (Updated Mar 2022)

A USD Lifeincome Plan provides a monthly/annual payout to the policy holder for life (Till age 99/120) after a period of accumulation. For the SGD Version of the plan, you may refer to this article. Premium for USD lifeincome plans can be paid with a lump sum or with regular premium. In this article, we will specifically identify two competitive single premium lump sum USD life income plans that are available in Singapore for people who are set to move into a more conservative lifestyle with predictable and higher yielding fixed income.

Reasons to choose USD Lifeincome Plan in Singapore

- Strong world reserve currency (USD)

- Rising interest rates may result in higher projected return and stronger currency

- Policy illustration shows higher guaranteed and projected yield than SGD policies

- Death coverage minimally provides principal + 5% guaranteed after payout.

- Shorter accumulation period before payout

- Stable and Predictable yields in the medium to long term with partial or full principal guaranteed.

As we enter 2022, the world is shifting from a low interest rate monetary policy to a higher and more sustainable interest rate environment. Such shift can be attributed to high inflation as well as the developed economies seeking to control monetary supplies which has been freestyling across the globe into risky asset classes.

Of course, there is not without disadvantages if one chooses to invest into USD currency plans.

Disadvantages Involved

- Currency Risk if your base currency is not USD

- Higher Cash Outlay

Purpose of Having LifeIncome Policies

Here are 2 USD Lifeincome Plans for Your consideration and the Benefits and Limitations

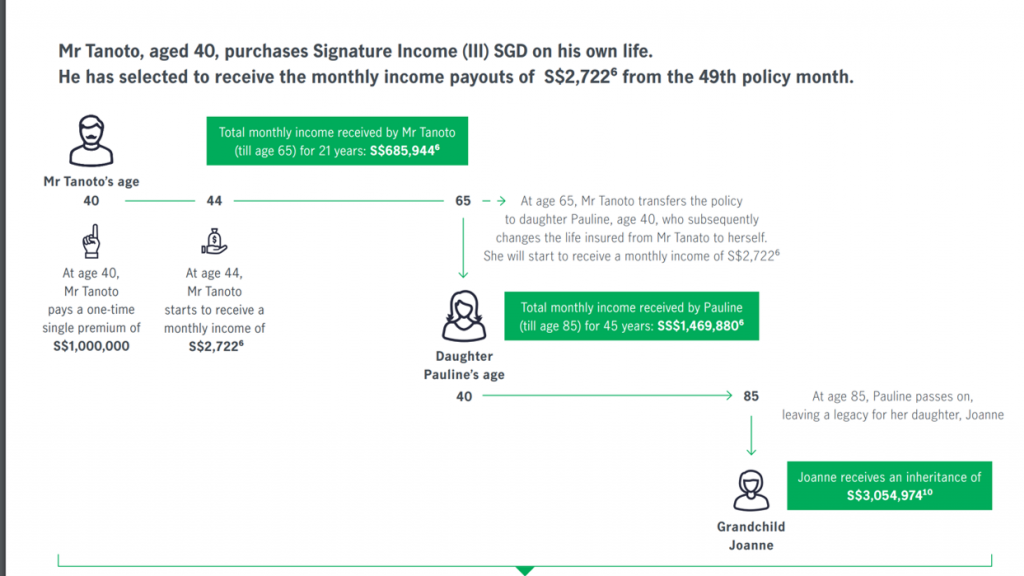

Manulife Signature Income III USD

source manulife.com.sg

Why we like it?

- Transfer of Life Assured

- Payout from 37th (4th policy year) or 49th Month (5th policy year)

- Guaranteed Issuance (No Med Underwriting)

- Payout till life assured reaches age 120

- Lower Capital Outlay from $81,811 USD

- From 1.7% p.a. interest income guaranteed to as high as 4.4% p.a. non guaranteed income from 37th month*

Limitation

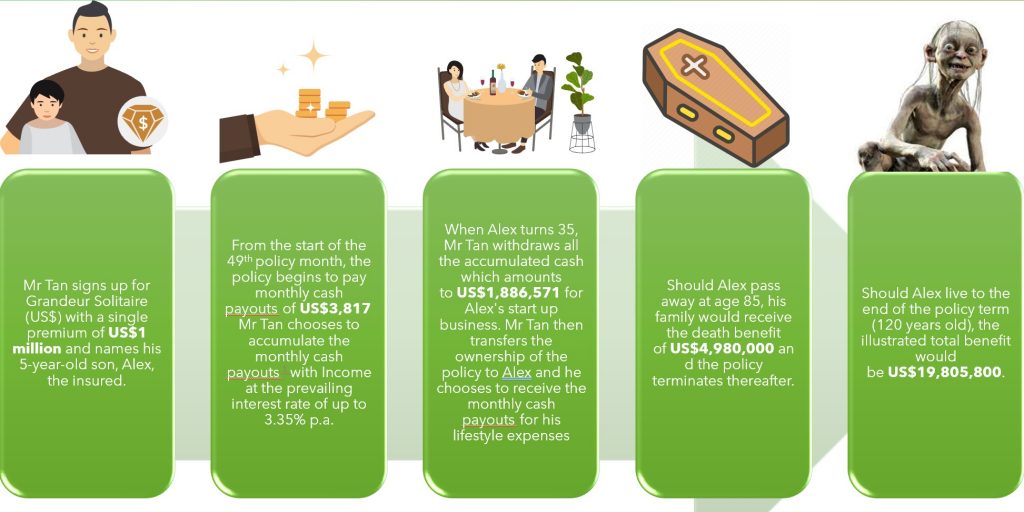

NTUC Grandeur Solitaire USD

source income.com.sg

Why we like it?

- The monthly cash payouts you receive can add up to 4.58% of your net single premium over a year (of which 1.77% is guaranteed and 2.81% is non-guaranteed).

- Payout from 49th Month (5th policy year)

- Guaranteed Issuance (No Med Underwriting)

- Payout till life assured reaches age 120

- Max entry age 75

Limitation

- Minimum to Start 200,000 USD

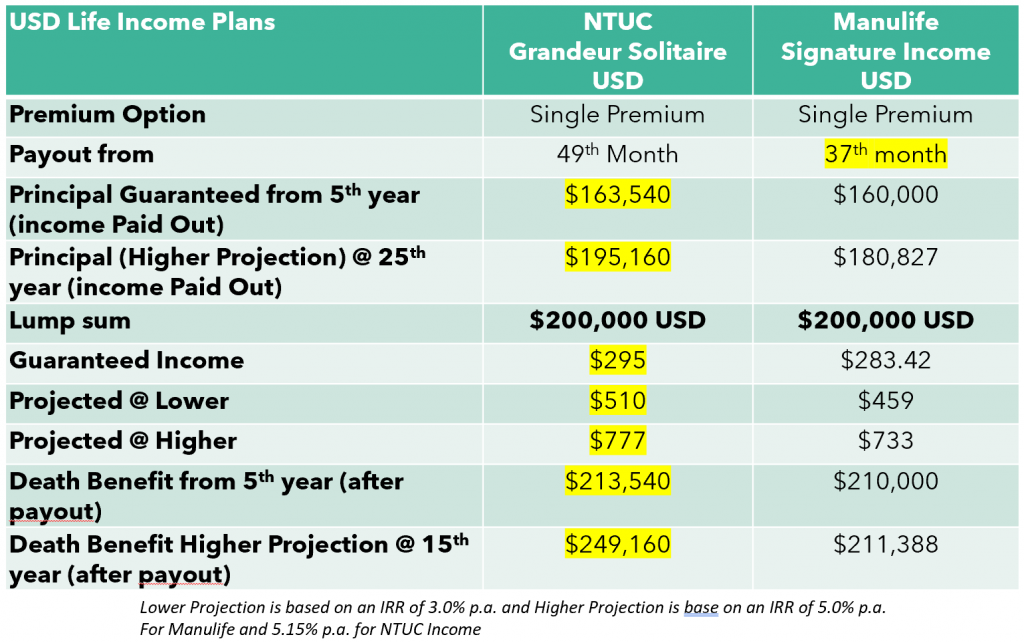

Head to Head Comparison

While the NTUC Income Grandeur Solitaire shows a better overall yield in terms of numbers. It requires a higher minimum capital outlay and will only payout from the beginning of the 5th policy year. The Manulife Signature income requires a lower capital outlay and it pays out income from the beginning of the 4th policy year. Max entry age for NTUC is 75 and Manulife is 70

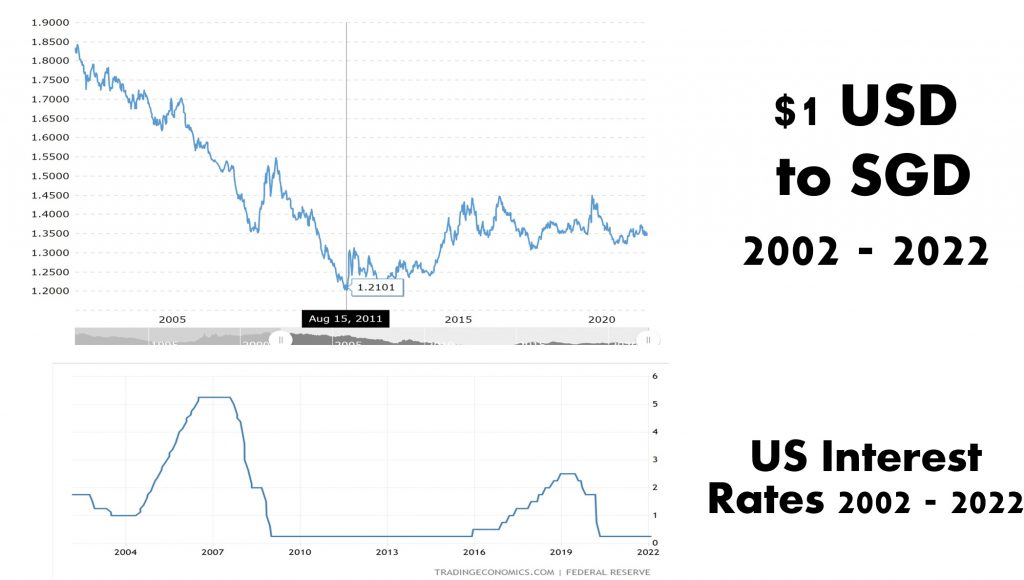

US Currency and Interest Rate Correlation

source

As we can see from these two charts, the USD strength and it’s interest rate are correlated when pegged against the SGD. From the mid of 2000 to late 2010s, the falling USD has significantly weakened the USD against SGD and went on to fall to an all time low of about $1.21SGD/USD. Afterwards the USD starts to stabilise around the $1.3 – $1.4 region as interest rates remain low throughout the late 2010s towards 2022. We finally see a slight uptick in USD as the federal reserve increase interest rates in 2019 follow by drastically reducing it when Covid19 crisis begins. With talks of significant interest rates increase in 2022, there are prediction that the exchange may see a significant difference from the current rate of $1.34 – $1.36 (in February 2022)

Should I Buy USD LifeIncome Plans?

Talk to us, it is important to find THE ONE that suits your financial needs, budget and risk appetite. While it might sound difficult in theory, it can be very easy in reality. Let us know a few details about you and we will structure a non obligatory session to understand your concerns.