Best Lifetime Income Plans in Singapore (Updated 2024)

Having a steady flow of cash flow is vital in financial planning. A positive cash flow ensures the health of your financial plan. The best lifetime income plans let you achieve your financial goals, be it getting a mortgage, taking a vacation or planning for retirement.

The idea of creating your own lasting source of cash flow and annuities through an income plan is slowly gaining prominence. Insurance companies have designed income plans to help you build a supplementary stream of cash flow (apart from your daily income).

If you are considering getting an income plan to create a lasting source of income for yourself and your loved ones, there are three good plans you can consider with the following benefts:

- Best Lifetime Income plan for Highest Guaranteed Income with Flexible Accumulation Features – Singlife Flexi Life Income II

- Best Lifetime Income Plan for Option to Choose Payout Mode (Annual/Monthly) – FWD Life income Plus

- Best Lifetime Income Plan for Highest Non Guaranteed Income – China Taiping Infinite Harvest Plus

Each of this income plan brings an interesting value proposition for you and me for wealth planning. But first, let’s understand how income plans work.

This article is for general information only it is not an advise nor does it take into account the specific investment objectives, financial situation or needs of any particular person. The article has not been reviewed by any of the providers mentioned. Read our General Disclaimer

Understanding How Lifetime Income Plans Works In 3 Simple Steps

While you might find convoluted explanations of how income plans work, here’s how an income plan works for you, in 3 simple steps.

- Choose your desired yearly/monthly income, or lump sum you wish to set aside.

- Let your capital accumulate through the accumulation period and wait for your yearly income to begin

- Once your accumulation period is over, you can start receiving a lifetime of yearly income from your insurer until you die or surrender.

Battle Of The Lifetime Income Plans: Singlife Flexi Life Income II vs FWD Life Income Plus vs China Taiping Infinite Harvest Plus

Before we dive into what we like about each income plan, here’s a quick summary of each of them, aka TL: DR version.

|

Singlife Flexi Life Income II |

FWD Life Income Plus |

China Taiping Infinite Harvest Plus |

| Premium Payment Term Options |

Single Premium, 3, 5, 10, 15, 20, 25 years |

Single Premium, 3, 5, 10 years |

Single Premium, 2, 3 years |

| Riders |

Cancer Premium Waiver II

EasyTerm

EasyPayer Premium Waiver |

NA |

NA |

| Single Premium Earliest Cash Payout |

From 37th Month

1.475% p.a. Guaranteed of Lump Sum

+

2.03% p.a. Non Guaranteed of Lump Sum Base on 4.25% p.a. Projection

Total Projected = 3.50% p.a.

Payout increased to 3.84% p.a. from 25th year |

From 37th Month

1.47% p.a. Guaranteed of Lump Sum

+

1.96% p.a. Non Guaranteed of Lump Sum Base on 4.25% p.a. Projection

Total Projected = 3.43% p.a.

|

From 37th Month

0.90% p.a. Guaranteed of Lump Sum

+

2.49% p.a. Non Guaranteed of Lump Sum Base on 4.25% p.a. Projection

Total Projected = 3.39% p.a.

|

| Special Features |

Capital guaranteed from 5th policy year onwards

Most Premium Term to choose from with Accumulation Option |

Option to transfer life, Capital Guaranteed from 3rd year for Single Premium or end of Premium Term, Option to choose payout frequency or Reinvest |

Choose to withdraw income from 37th month or 49th month (RP) |

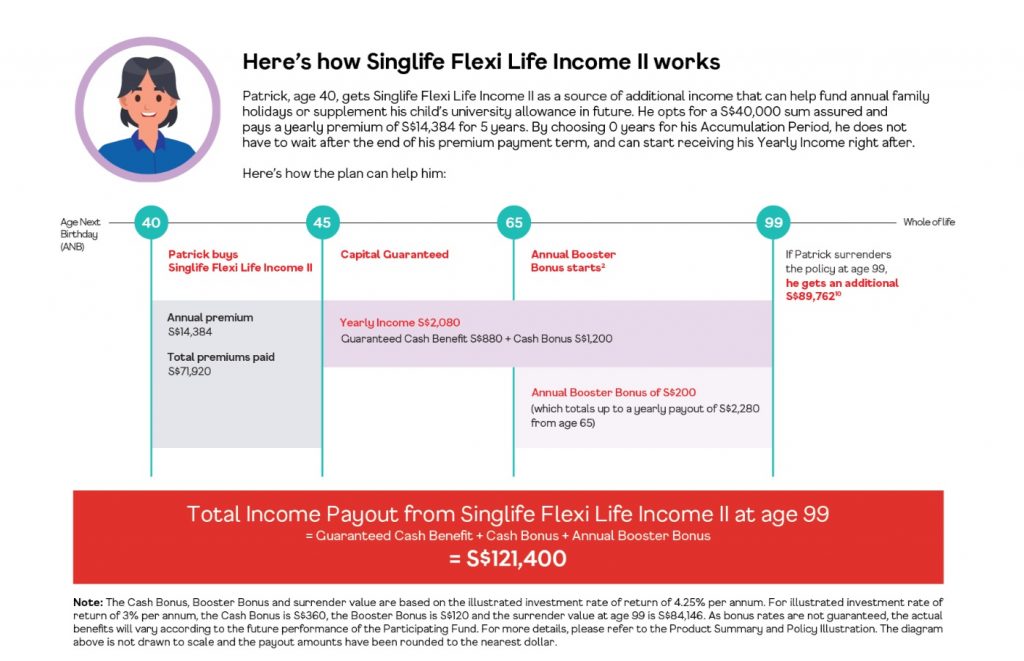

What is Special About Singlife Flexi Life Income II

Source: Singlife

Singlife Flexi Life Income II Principal Guaranteed and Flexibility

The Singlife Flexi Life Income II provides a flexible option for you to save and accumulate to start your first income payout. it has a feature where the payouts increase by 0.5% of your sum assured starting from 20 years after your first income payout or when you turn 60, whichever is later. The capital is also guaranteed, and you can choose when to start receiving cash payouts. Additionally, the plan provides financial protection against death and terminal illness, and more riders can be added to the plan. The extra funds can be used for holidays, retirement, or any other purpose.

What We Like About FWD Life Income Plus

Source: FWD

FWD Life income Plus Provides Option to Continue Your Policy to the Next Generation and Choose Payout Mode

With our secondary person insured option, you have the peace of mind knowing that a trusted loved one can seamlessly take over the policy if the primary insured passes away. This means the benefits, like Cash Benefit payouts, can continue for your family’s next generation. Plus, with the flexibility to transfer policy ownership and change the person insured, you’re empowered to safeguard your family’s financial future. Client also enjoys the flexibility to receive your cash benefit payouts either monthly or yearly, First in market, and you may even choose to accumulate your cash benefit payouts with us at an interest rate of up to 3.25% p.a.

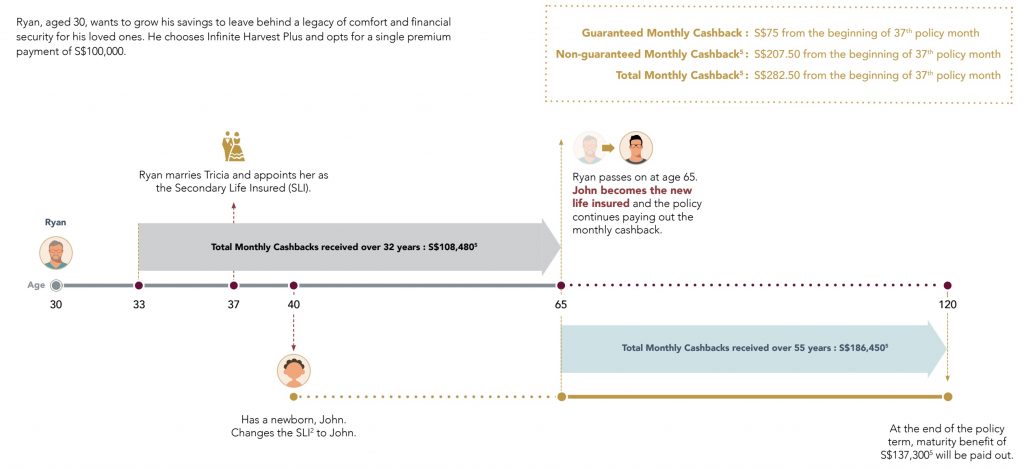

What We Like About China Taiping Infinite Harvest Plus

China Taiping Provides Earliest Principal Guaranteed with a Lifetime Stream of Income

China Taiping Provides Earliest Principal Guaranteed with a Lifetime Stream of Income

China Taiping Infinite Harvest Plus is a savings plan that provides a continuous stream of monthly cashback until the age of 120. The plan also offers a Secondary Life Insured (SLI) option to ensure policy continuity. The feature that stood out the most is that the plan guarantees 100% capital from as early as the end of the 3rd policy year with monthly income paidout from the 37th month onwards. There is also flexibility in premium payment terms, with the choice of a single premium, two, or three-year premium term. In the event of premature death, the policyholder’s beneficiaries will receive a lump sum benefit. With these benefits, China Taiping Infinite Harvest Plus provides a comprehensive savings plan for those looking to secure their financial future.

Finding THE ONE For You Can Be Easy

We have more options for you: Check out our Lifetime income Comparison page

Since each income plan comes with its own set of unique features, it is important to find THE ONE that suits your financial needs. While it might sound difficult in theory, it can be very easy in reality. Let us know your income appetite and we will structure the best policy that suits your needs.

25 Comments