Is Expat Insurance in Singapore a Necessity?

Expat Insurance in Singapore — Are you an expatriate in Singapore? Are you in the process of moving overseas and looking at insurance options? Do you know how to find the ideal insurance? If no, then you’ve come to the right place. This article highlights a lot of relevant information about what expatriate insurance means, who should be covered for this, how to source for one that you can afford and also why it is essential. It also goes into several other benefits expat insurance can give you.

Expat Insurance in Singapore: What Is It?

Expats are people who live outside their home country, usually due to work or study reasons.

Expat insurance is a vital form of international health coverage for expatriates and their families relocating to Singapore. Singapore, as an emerging market in Asia, has seen a significant increase in growth in recent years and as a result, there is a growing demand for expat insurance.

Expats moving to Singapore should ensure they have expat insurance in place as the country has different healthcare regulations compared to their home country. Without coverage prior to arrival, expats may find it challenging or even impossible to access medical care, prescriptions, and other healthcare services without incurring significant out-of-pocket expenses. It is essential for expats to secure expat insurance coverage to ensure they have access to quality healthcare while living in Singapore.

Types of expat insurance in Singapore

Expatriates need to have expatriate insurance because they are away from their home country and are unable to take advantage of their own national health care systems or other benefits.

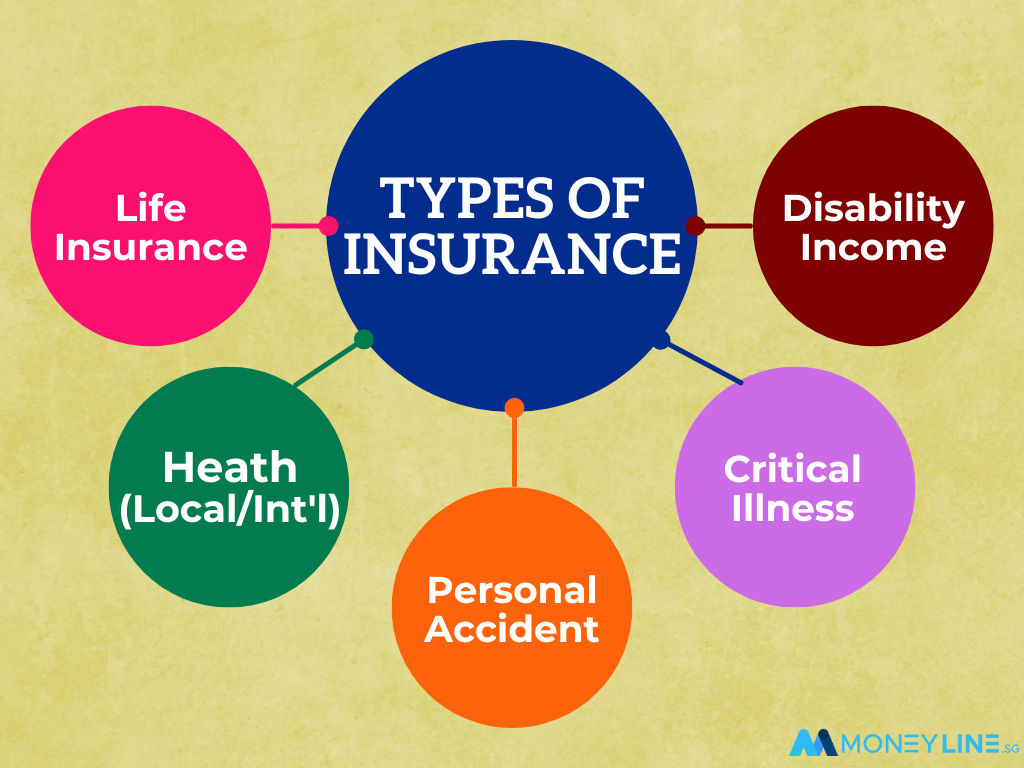

The types of Expatriate Insurance plans available include:

- Life Insurance – Provides you with financial support in the event of death or severe disability.

- Health Insurance – Provides you with access to healthcare while in Singapore. You may be able to get this through your employer or through private health care providers in your host country.

- Personal Accident Insurance – Protects you financially if you’re injured in an accident.

- Critical Illness Insurance – Provides coverage for certain specific conditions such as heart attack and stroke if they occur while you’re outside your home country. These critical illness conditions must be listed on the plan before purchasing it so make sure to check this before signing up for any policy!

- Income disability insurance – This type of policy helps replace your income if you’re unable to work due to illness or injury while living outside your home country.

Why Is Expat Insurance Necessary?

Expat insurance in Singapore is a crucial aspect of planning for your family’s well-being while living abroad. As an expat, you may be unfamiliar with the local laws and customs, which can put you at risk of unexpected events such as accidents or illness. Expat insurance in Singapore provides protection against these potential hazards by ensuring that you have coverage for medical expenses and other related costs. Without it, you may be faced with financial burden during a time of need. It is essential for expats to secure expat insurance coverage to safeguard their family’s health and financial stability while living in Singapore.

The Benefits of Expat Insurance in Singapore

Expatriate insurance in Singapore offers multiple benefits, including reimbursement for medical expenses, quality medical treatment without financial burden, and protection against financial difficulties during transition period. It’s essential to have expat insurance in place to safeguard yourself and your family’s health and financial stability while living abroad.

Criteria for Selecting an Insurance Broker

When choosing an insurance broker, you should look for someone who is knowledgeable and experienced. A good broker will know the different types of coverage and be able to help you make a decision.

A good broker will also be able to provide guidance on what type of policy fits your needs and answer any questions you have about your policy. They should be able to explain how insurance works, including what options you have when it comes time to renew your policy.

A good insurance broker will:

- Be familiar with the local market and its regulations.

- Have access to a wide range of insurance providers.

- Be able to find you the right combination of coverage and price.

- Work hard to get you the best policy for your needs.

Health Insurance: Going Local or International?

Expat insurance in Singapore is a great way to protect your assets and your family.

If you are an expat, or will be relocating to Singapore, it is important to understand the types of policies that you can purchase and how they can benefit you.

Expats usually have one of two choices when it comes to health insurance: local or international. The two main types of expat insurance in Singapore are:

International insurance – This type of policy will cover you anywhere in the world, including Singapore. However, these policies tend to be more expensive and may not provide as much coverage as local policies.

Local insurance – Local policies are designed specifically for people who reside in Singapore on a full-time basis. These policies have lower premiums than international policies because they do not have as high-risk factors associated with them.

Section: Expat insurance in Singapore can work for people from anywhere.

Expat insurance in Singapore is an important consideration for anyone living or working in the country. Most expats in Singapore have to have health insurance and life insurance, both of which can be purchased locally in Singapore.

There are many benefits to expat insurance in Singapore, including:

You can buy expat insurance no matter which country you are from, as long as you reside or work in Singapore. Insurance purchased in Singapore provides international coverage, with the exception of local health insurance.

You can purchase different types of coverage based on your needs and preferences. For example, there are several options for medical coverage, allowing you to choose the benefits that are best suited to your situation.

Your policy will automatically cover any changes that come up during your stay in Singapore by providing coverage for new medical conditions and injuries that occur while living here.

Takeaway: Expat insurance in Singapore is a great way to ensure that you and your family have the protection that you need.

Maintaining adequate coverage for your expat insurance in Singapore is absolutely essential, and purchasing coverage that meets your needs will be incredibly beneficial. Do yourself and your family a favor, and make sure that you’ve got the right plan.

Expat insurance in Singapore is only effective when you take the time to make sure you have an adequate plan and coverage. Speak with our experts today to find the best plan and coverage for you, your family and your future!

1 Comment