4 Big Questions To Ask About The New Property Cooling Measures 2022

Here are 4 big questions we think many homebuyers like yourself will be thinking about as you find out about the new property cooling measures. While the whole of Singapore was focused on the “Lie Gate” saga that happened in the parliament, the government dropped a bombshell on the rest of Singapore. On the night of 15th December 2021, the government decided that it was time to introduce new property cooling measures so that Singapore’s property market doesn’t run the risk of overheating.

-

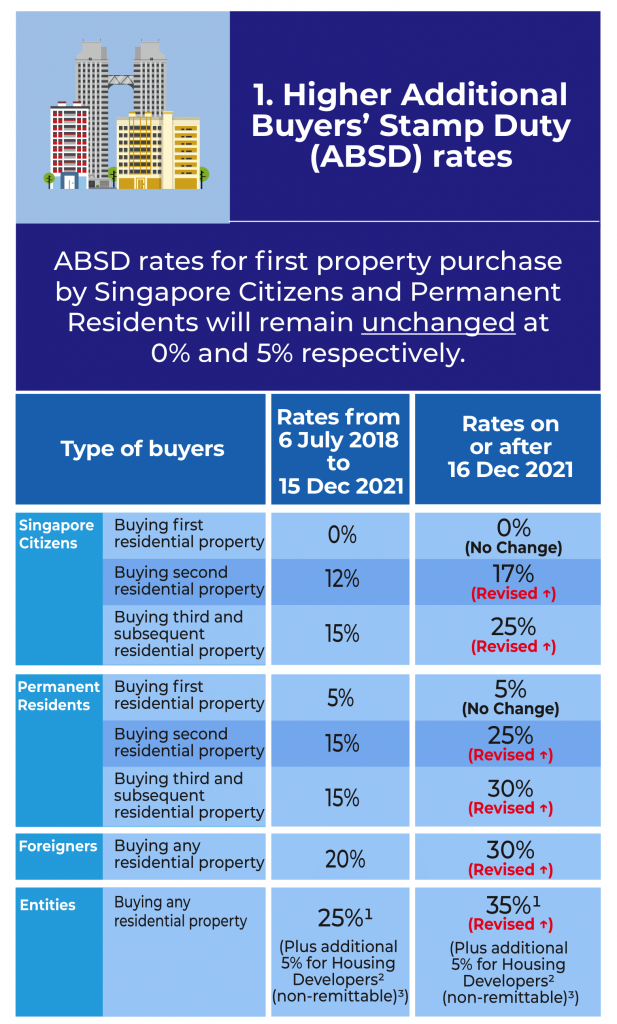

ABSD Hike: Will Homebuyers Still Want To Own a 2nd Property?

Source: MND

The most prominent measure among the property cooling measures introduced has to be the Additional Buyer Stamp Duty (ABSD).

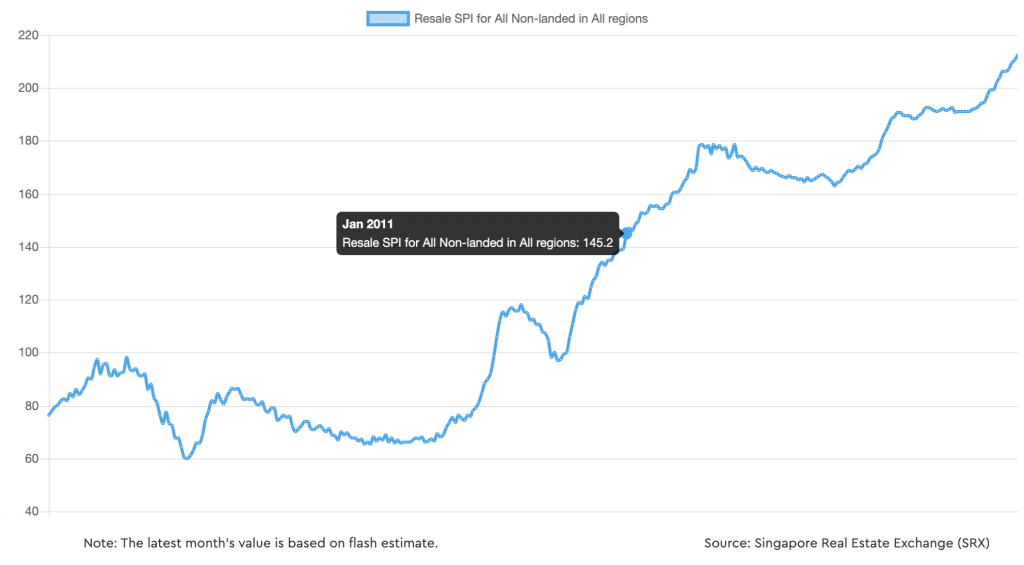

Source: SRX

The ABSD was first introduced in 2011. Back then, the Singapore Property Index (SPI) for non-landed properties was 145.2. Since then, a series of ABSD hikes were introduced in 2013, 2018 and the latest one in December 2021. However, any increase in ABSD seems to fail to curb the growth in property prices in the medium to long term. Some merely had a very short term effect.

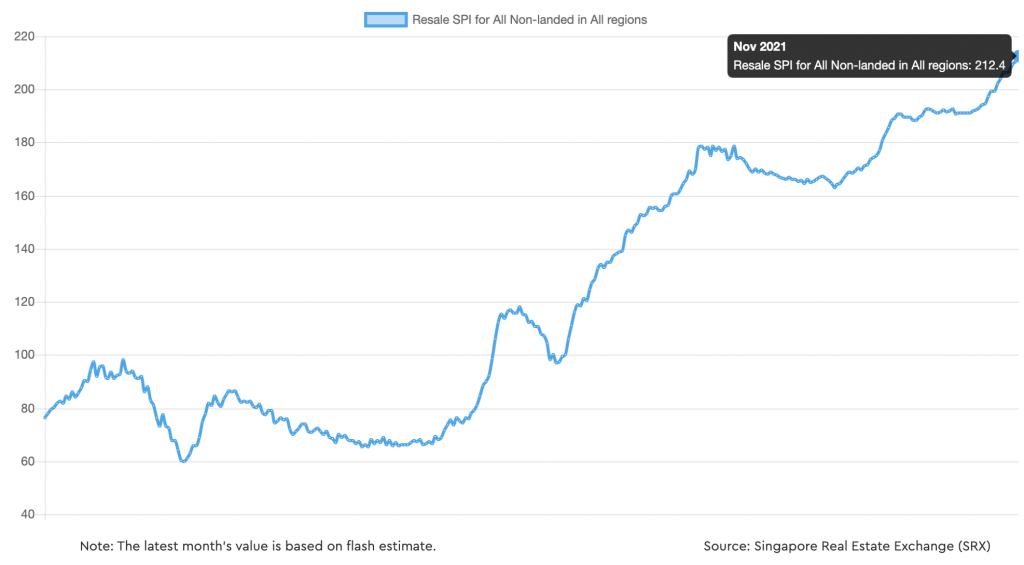

Source: SRX

Today, as of November 2021, the SPI is at 212.4. With the SPI for non-landed at an all-time high, it is no wonder why the government wants to introduce higher ABSD to prevent the property market from destabilizing.

In our view, the latest ABSD hike is making it much less appealing for anyone to be owning multiple properties. Having ABSD at 17% for Singaporeans and 25% for PRs mean that you will take a paper loss on your property the moment you invest in a second property. That’s like taking a negative discount on your investment.

-

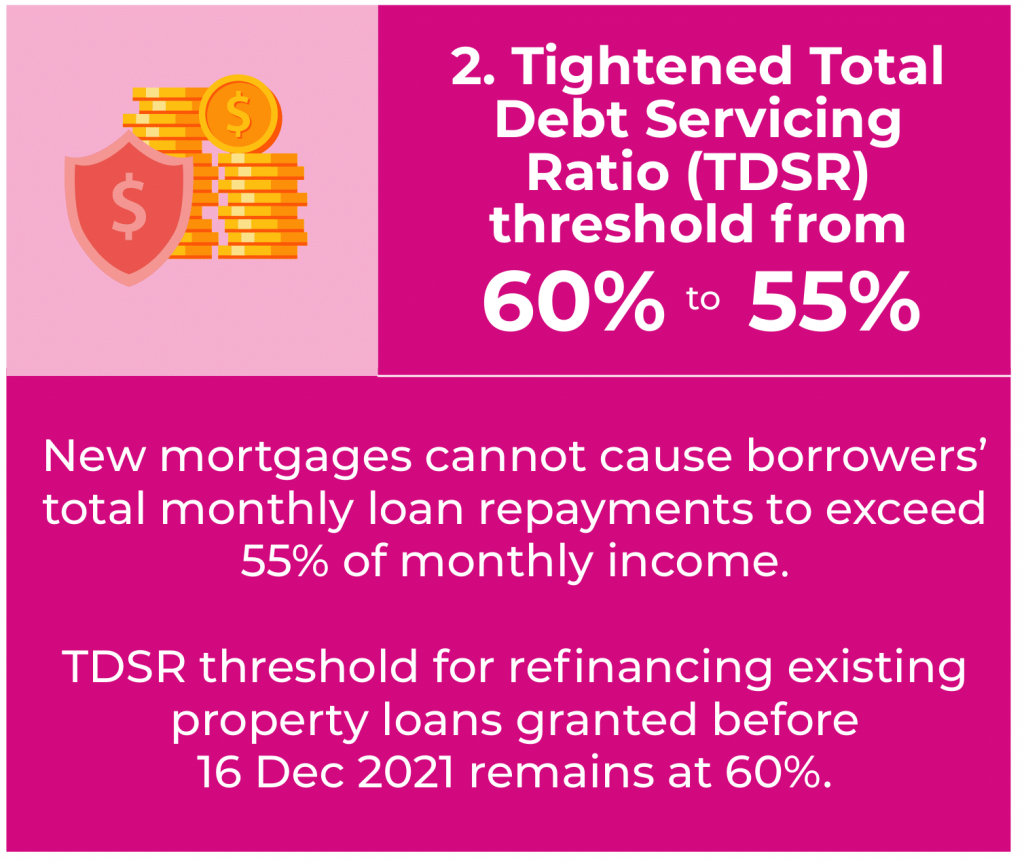

TDSR Limit Reduced: Can I Still Afford A Condo?

Source: MND

Under the new property cooling measures, the Total Debt Servicing Ratio (TDSR) will be cut to 55%. For homebuyers, this will affect the amount that you can borrow from the bank to finance your property purchase. Unlike ABSD which affects owners that buy their second (or more) property, the lowering of TDSR limit will affect all condo buyers. This is regardless whether it is your first property or not.

The impact of lower TDSR will affect homebuyers’ affordability in two ways. The first is that you will need a higher combined household income to afford the same loan amount. The second is that if your household income stays the same (which is more likely), then you will need to fork out more cash/CPF as down payment since the amount you can borrow from the bank is reduced.

-

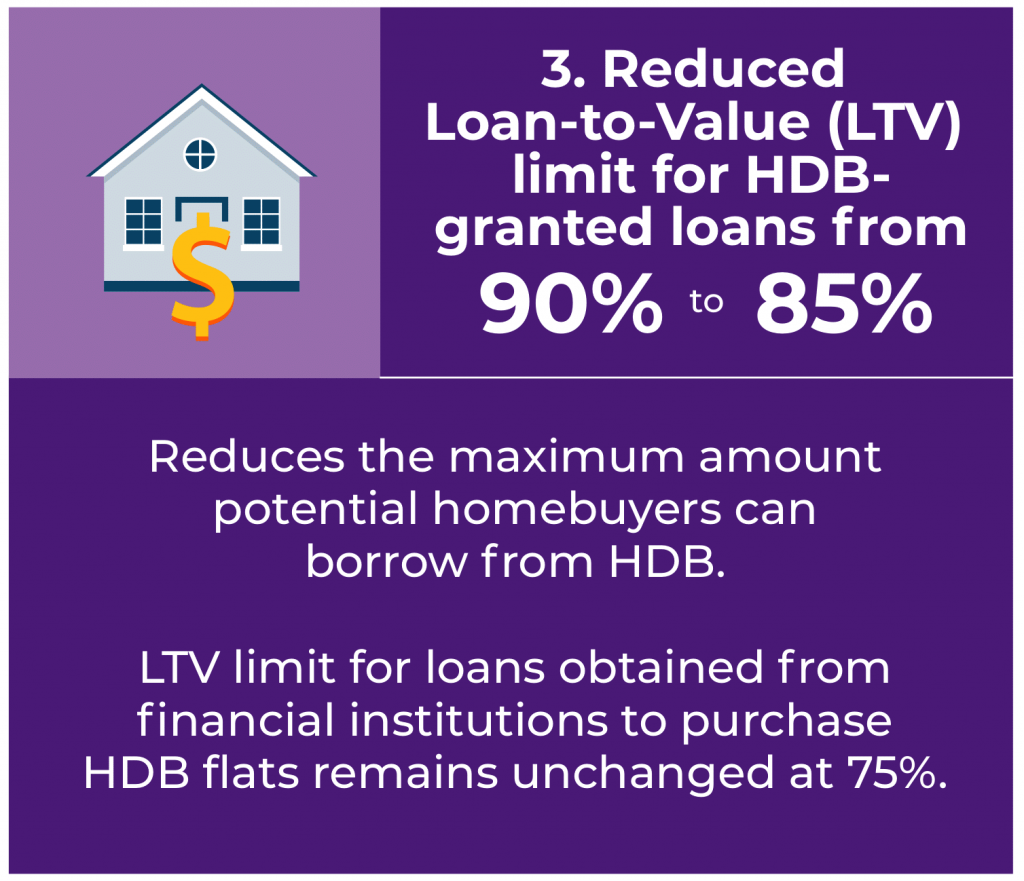

LTV Limit Reduced: Is HDB Housing Loan Losing Its Appeal?

Source: MND

The third measure introduced by the government as part of this round of property cooling measures is the reduction of Loan-To-Value (LTV) for HDB housing loan. In simple terms, the lower the LTV, the less you can borrow from HDB to finance your HDB purchase.

With LTV set at 85%, this means that you can only borrow up to 85% of your purchase price. The remaining 15% has to be either from cash or CPF. If the resale flat you are planning to buy is valued at $700k, you can only borrow up to $595k. The remaining $105k will need to be in cash or CPF.

The sudden change in LTV for HDB really affects affordability of first-time homebuyers, especially those who have just started their career.

At the same time, the lower LTV for HDB housing loan also narrows the gap between bank loan and HDB loan. After all, with bank loan, you get 75% LTV but you enjoy a much lower interest rate (1% vs 2.6% for HDB loan).

-

What Can I Still Afford Based On The New Property Cooling Measures 2022?

As a homebuyer, it is important to know your budget first before you start home shopping. You don’t want to be in a situation where you found your dream home but end up being disappointed because you realized that you don’t have the budget for it.

With the new cooling measures, it can be hard to figure out what you can still afford based on your current income and assets. Why not set up an appointment with Moneyline where we help you to review your financial portfolio?

1 Comment