TM #goAffluence: Investing with Retrenchment Protection

Face with the uncertainty in today’s global climate, one may wonder how to put their money to work when their work maybe put into question. The old saying of buying the dip is not a question of will but a question of how, especially when the probability of unforeseen financial circumstances increases during economic turmoil.

As such, the solution to this may be TM #goAffluence. Have you wondered how to continue investing when the market is down, and you lose your job due to retrenchment? We explore and understand TM #goAffluence retrenchment benefit and other perks to aid your growth towards an affluent life.

This is not a recommendation, Moneyline.SG is not an Exempt Financial Adviser and act only as an information portal, please seek advice from a licensed financial advisor or leave your contact details below for a proper fact find by a licensed practitioner before making any decision. All information provided are public and can be found directly on the providers website or via any financial representatives that represents the product provider.

Here is a quick description of TM #goAffluence

TM #goAffluence

#goAffluence is a limited-pay whole life, investment linked plan by Tokio Marine. Just like a typical ILP these days, it provides start up bonuses and full money invested with little to no insurance coverage for a selected premium term.

Entry Age starts at 19 and ends at age 75 (including premium payment term)

Payment Term

Customer can select their preferred Premium term for TM #goAffluence from 15 to 30 years with unlimited premium holidays from the 25th month of the policy and enjoys no hidden penalties if exercised.

Premium Size

Customers can start with a premium as low as 300/mth for a premium term of 20 – 30 years or start from $500/mth for a premium term of 15 – 19 years.

Locked in Amount

The first 24 months of premium contribution is compulsory and will be locked in for the selected premium term chosen by the policy owner.

Benefits

TM #goAffluence comes with a multitude of benefit as with any ILP Plan

Bonuses

Bonuses are not only meant to help accelerate your portfolio growth but also to help defray policy and insurance charges in a typical ILP policy to bring down the breakeven yield.

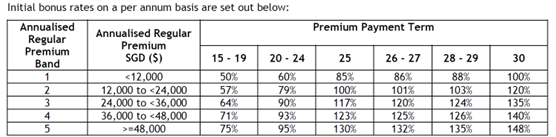

Receive initial bonus up to 296% – When the policy is in force, an initial bonus will be paid out over two policy year from 50% per annum to a max of 148% per annum on the annual premium paid.

Earn a Loyalty Bonus – Policyholder will enjoy 0.70 – 0.75% from year 3 to 10 and 0.99% p.a. from 11th policy year onwards as long as policy is inforce

Earn up to 85% Achievement Bonus of annualised premium. – Investor will earn a yearly achievement bonus that can be unlocked each year as long as the following 3 conditions are satisfied

(i) There is no premium holiday taken prior to the end of eligible policy year(s);

(ii) There is no reduction in the Regular Premium prior to the end of eligible policy year(s); and

(iii) There is no partial withdrawal made from Accumulation Units Account made prior to the end of eligible policy year(s).

Advanced Death Benefit

The Advanced death benefit protects the principal invested in the event of the life insured’s death during premium payment term. This option will pay out up to 101% of policy value or premiums paid.

Accidental Death Benefit and Medical Reimbursement

During the premium payment term and before the policy anniversary on which the life assured is Age 75, if the life assured dies due to an injury on or within 180 days from the date of accident while this policy is in force, TM will pay the Accidental Death Benefit based on annualised regular premium band with up to 100,000 and 2 times the sum assured in the event of accidental death while travelling on any mode of transports covered under the policy

TM will also provide Medical Reimbursement due to accident up to a limited of $2,500 per accident for inpatient treatment and up to $500 per accident for any outpatient treatment which includes chiro and TCM.

Retrenchment Benefit

First in market. If the policy is in force for at least 24 months and without premium holiday taken during and before the end of the premium payment term, in the event if the policyowner gets retrenched or remain unemployed for a minimum period of 30 consecutive days, Tokio Marine #goAffluence will waive future regular premiums payable under the basic policy for up to 12 months. The waiver of premium will commence from the next premium due date immediately after receiving and the approval your application on Retrenchment Benefit.

This means, your policy will be paid for by Tokio Marine for up to 12 months for this retrenchment benefit.

Access to Accredited Investor Funds for Retail Investors

TM #goAffluence investor gets access to the TM ILP Universe of Funds, these funds includes Accredited Investors Fund like Fundsmith Equity as well as Baillie Gifford which is typically not accessible via the retail investors platform in Singapore.

Things to look out for

While this plans current remains tip top on it’s benefit structure, there are a few things to look out for in a typical investment focused ILP.

Charges

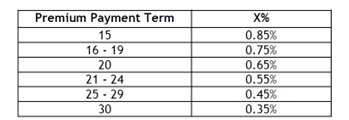

Initial Charges and Policy Charges – Initial charge of up to 0.85% p.a and Policy Charge of 1.2% p.a.. will be deducted throughout the policy term selected by the policy owner.

Monthly Protection Charges – Monthly protection charges are applicable only if the Advanced Death Benefit feature is selected by the Policyowner, MPC depends on the sex and the age of the life assured and will be deducted during the selected premium term.

Surrender Charges – Surrender charges will only be deducted upon termination of the whole policy during the premium payment term. The charges will be levied upon the initial account value (first 24 months premium paid value of the policy)

Fund Management Fee

Fund management fees are levied by the individual funds selected by the investors

Top Up

A 5% charge will be charged on any adhoc single premium top up during the premium payment term

Principal are not guaranteed

As with all investments, principal of your funds are not guaranteed by any institution, TM or the fundhouses themselves unless otherwise stated. The projection shown on the Benefit illustration are typically shown on all insurers’ ILP Benefit illustrations @ 4% or 8%. They are no way an indication of the potential performance of the funds in the past or in the future.

Conclusion

As all insurers are becoming more like an investment platform and releasing multiple range of ILP products, it is to the benefit of consumers to be aware of the pitfalls of investing in ILP. Nonetheless, if the right portfolio and approach to investing is practiced, consumers will stand to benefit more in the long run with such plans due to more control and flexibilities. TM #goAffluence provides protection against life uncertainties with complimentary and unique retrenchment benefit and accidental insurance coverages. The plan also has strong welcome bonus to provide accelerated gains in portfolio and also defray policy charges throughout the term of the policy. So far this is the first of it’s kind but will not be the last to revolutionise ILP.

3 Comments