Myth Busted! HDB Is No Longer The Sure-Fire Way To Retire. Here’s How To Save Your Retirement Plan

In a country like Singapore where home ownership is more than 90%, relying on your home as a source of retirement is the norm. Indeed, that’s what our parents have been doing. It is also what we have become so used to. Honestly, with most of us born and raised under this environment, it is almost ingrained in our minds that HDB is the best source of retirement. However, the traditional mindset of relying on HDB as a source of retirement income is no longer the sure-fire way of retiring. Here’s why.

Cambridge Study: Singaporeans Are ‘Asset Rich But Cash Poor’

According to a study by Cambridge University, Singaporeans face the risk of being ‘asset rich and cash poor’ for retirement.

Because of the way CPF system was designed to encourage home ownership, Singaporeans leverage on our CPF to purchase our first home at the earliest opportunity since the incentives favour home ownership in housing and property upgrading. The earlier you own your first property, the higher chance of you making money from your property.

Right Sizing Or Lease Buyback Scheme To Unlock HDB Value

However, it is difficult for Singaporeans to unlock the price appreciation in your HDB. At the moment, there are only 2 ways you can unlock value in your HDB: Either right sizing or selling your lease back to HDB under the Lease Buyback Scheme (LBS).

But Can You Really Get Cash Out From Right Sizing Or Lease Buyback Scheme?

For right sizing, it means that you will need to sell your HDB in the resale market and buy a smaller unit from the resale market. For LBS, you will need to sell a portion of your remaining lease back to HDB. But the question remains. Can you really get cash out of your HDB from right sizing or LBS?

Upon right sizing or LBS, you will need to top up your CPF Retirement Account (RA) till you hit the Basic or Full Retirement Sum. You can get cash out of your HDB only if you hit the Basic or Full Retirement Sum.

Is HDB Still An Investment That Will Never Fail?

In order for you to make money on your HDB, you will need HDB price to appreciate. Not just that, the housing value also needs to continue to rise faster than inflation and the 2.5% interest rate that needs to be “paid back” to CPF.

What Happens If The Housing Market Tanks?

If the housing market takes a dip and remains depressed, your retirement asset will shrink substantially. Indeed, this is what happened to Japan when the housing bubble in the 1990s burst and they are still suffering till today.

Can HDB Prices Still Appreciate Like It Used To?

There’s another thing that past generations of Singaporeans like our parents didn’t have to think about: Can HDB prices still appreciate like it used to?

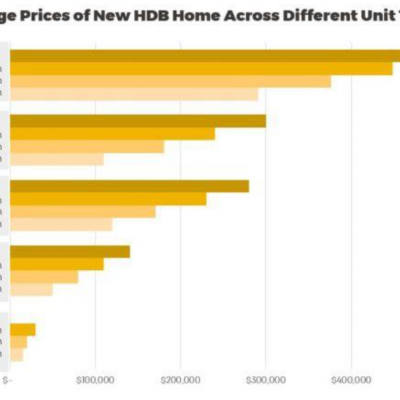

Since 2009, resale HDB prices have been increasing. This led to Build-To-Order (BTO) launches being pegged to resale HDB prices. This was unlike in the past where BTO prices were differentiated by size and whether it was in a mature or non-mature estate. For young Singaporeans, can we really expect to see our HDB home appreciate when we buy BTO?

Source: Workers Party Working Paper on HDB resale prices

How To Save Your Retirement Plan?

To save your retirement plan, the first thing you need to do is to acknowledge that HDBs are no longer the sure-fire way to retire. Then, you will need to make a more comprehensive plan for retirement by including a suite of financial products in your financial portfolio.

Instead of just having your HDB and a few savings account as your retirement plan, you have to think about supplementing your retirement plan with other financial products such as retirement plan, endowment plan and stock investments to create your desired retirement cash flow.

Check out some of the 3 best retirement plans in Singapore to bolster your retirement planning today.

The earlier you snap out of the traditional mindset of relying on HDB for retirement, the more chance you have of salvaging your retirement plan.