MediShield Life Changes: What’s New? And Is It Now Comprehensive Enough?

Living in Singapore is an expensive affair. From housing to healthcare costs, the cost of living in Singapore has been consistently increasing. Luckily for Singaporeans, the Singapore government is trying its best to help defray those costs by providing MediShield Life for Singaporeans to enjoy basic healthcare without having to fork out of your own pocket

Most recently, the government has introduced some new changes to the existing MediShield Life coverage to further enhance healthcare protection. They are even been engaging Singaporeans with a public consultation to get feedback on what can be further improved for MediShield Life.

We dive into the recent changes and analyse whether MediShield Life is now comprehensive enough to be the only universal medical insurance in one’s financial portfolio.

A Summary Of What’s Changed

| Claim Type |

Current |

Proposed |

+/- |

| Day Surgery

(above 80 years old) |

$3,000 |

$2,000 |

Opinion: Good for majority, bad for older patients

Healthcare treatment for older patients are typically more costly. |

| Private Hospital

(including day surgery) |

35% pro-rated |

25% pro-rated |

Opinion: Good for the majority, bad for private hospital patients

The lower pro-ration rate means that private treatments are being subsidised less. This will reduce the burden on the majority of Singaporeans who are seeking treatment at the cheaper and more affordable public hospitals |

| Attempted suicide, intentional self-injury, drugs and alcohol abuse |

Excluded |

Included |

Opinion: More observations required

This is a new type of claim that will be included post the review. The effect on the scheme is still not known, but sentiment wise, it is a positive one. |

| Normal Ward |

$700 per day |

$800 per day |

Opinion: Good, makes healthcare more affordable

All these increase the affordability of the basic healthcare services that average Singaporeans might need, especially for those facing acute illness. |

| ICU Ward |

$1,200 per day |

$2,200 per day |

| Sub-Acute Care |

$350 per day |

$430 per day |

| Radiotherapy for Cancer |

$140 per treatment |

$300 (External Radiotherapy) / $900 (Hemi-Body Radiotherapy) per treatment |

| Claim Limit |

$100k per year |

$150k per year |

Opinion: Good, makes healthcare more affordable

The increase in claim limit is a wise move by the government to ensure that all Singaporeans can afford basic healthcare in Singapore. But we do wonder if $150k is the right number. |

MediShield Life Changes: How much Increase in Premium? What About Subsidies?

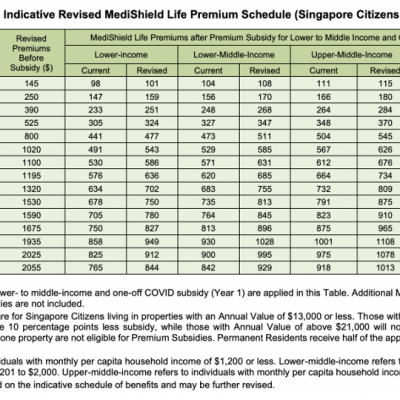

With the proposed changes for MediShield Life, there will be greater coverage for Singaporeans under the scheme. Greater coverage is a good thing, but it does come at a cost, literally. Singaporeans can expect to pay higher premiums for your MediShield Life coverage even though it will come from your MediSave account anyway.

Source: MOH

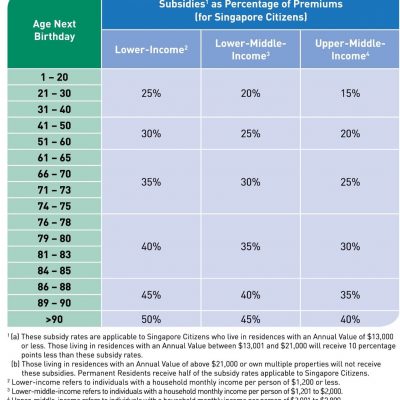

Prior to any government subsidies, the premium increase ranges from 10% (1-20 years old) to almost 40% for the older age groups. But post-subsidies, the increase in premium for most age groups will be around 10% (+/-).

Source: MOH

Source: MOH

MediShield Life Changes: Does it Make MediShield Life Comprehensive Enough?

While we do applaud the government’s efforts to constantly review and adjust the basic healthcare protection for Singaporeans, one question still lingers in our minds. Does this make MediShield Life comprehensive enough? Will it eliminate the need for private insurance, i.e. Integrated Shield Plan (ISP)?

According to the Singapore Department of Statistics, the cost of Medical & Dental Treatment has risen nearly 78% in the last 20 years. This translates to 2.9% p.a., which is almost double the 20-year inflation rate of the MAS Core Inflation Measure (1.5%). This trend will continue to increase in Singapore that will lead to higher long-term medical costs. So, if you think that $150k is enough, you might want to think again.

Medical inflation is just one of the factors. The other factor to consider is your personal preference. When you fall sick, what kind of ward class do you want to receive treatment in? A, B1 or private treatment? The better the ward class you choose, the more it will cost and the more it will make the basic healthcare protection of MediShield Life seem insufficient.

The government recognises this and that’s why they are encouraging those who require more medical insurance coverage to top up for your own private insurance with ISP.

Disclaimer: This article is for general information only it is not an advise nor does it take into account the specific investment objectives, financial situation or needs of any particular person. We recommend that you seek the advice of a qualified financial advisory professional before making any decision to purchase an insurance or investment product. Whilst we have taken reasonable care to ensure that all information provided was obtained from reliable sources and correct at time of publishing, information may become outdated and opinions may change. We are not liable for any loss that may result from the access or use of the information herein provided. Read our General Disclaimer

How To Upgrade Your MediShield Life With ISP?

If you find that you need more coverage for your medical insurance (just like us), you should upgrade your MediShield Life With ISP early so that you do not face any issues of exclusion.

And upgrading your MediShield Life With ISP is not difficult. You can find a quick primer on all you need to know about health insurance here. Alternatively, you can reach out to us to help you analyse your financial plan and choose the right healthcare insurance for your medical protection.

1 Comment