Manulife Smart Retire II: For Your Retirement & Legacy Planning

Just in case you’re unaware, the Manulife Smart Retire II is an Investment-linked policy, we have discussed investment-linked policy in our article Best Investment-Linked Policy in Singapore and we highlighted some pitfalls as well as benefits of getting one. In this article, we will be uncovering the pros and cons of the Manulife Smart Retire II, the plan is neither simply a 101 product nor Investment-linked policies with high life insurance coverage.

Here is how it works:

Source: Manulife.com.sg

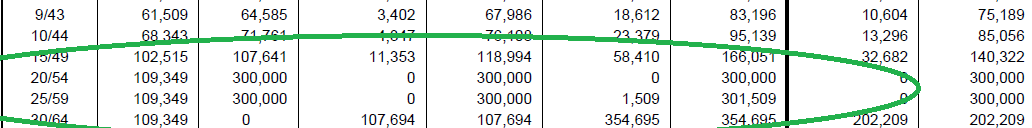

First, the plan itself is catered specifically for retirement purpose and you will be able to choose a targeted retirement age from 40 – 70 years old in blocks of 5 years differences. You may then choose to receive a lump sum or a stream of targeted retirement income for a specified pay-out period. You then select the number of years you would like to invest for and Manulife will generate the premium amount you will need to fork out each on a monthly/quarterly/semi-annual/annual basis.

How does Manulife Smart Retire II stand out?

There are a few ways how the Manulife Smart Retire II stands out from a typical 101 Investment-linked policy. Here are the 3 main benefits

-

Cost of Insurance Refund

The major pitfall of ILP is the cost of insurance, the cost of insurance charges you when the current surrender value of the policy is lower than the sum assured. Not only will the charges continue to be imposed year after year but it also increases as the life assured aged if the policy value continues to be lesser than the death coverage.

The Manulife Smart Retire II will refund the COI charged during the course of your policy will be if protection benefits are not utilized during the Minimum Investment Period (MIP) follow by Accumulation period. Here is a simple explanation on how the COI can be refunded

| COI Charged |

Refund During |

| MIP Period |

Accumulation Period |

| Accumulation Period |

Targeted Retirement Period |

To be exact, the cost of insurance charged during MIP will be refunded during First 5 years of accumulation period if no claim is made whilst the Cost of insurance charged during Accumulation period will be refunded during the first 5 years after the targeted retirement age. Refund will be in the form of additional units.

-

Coverage Bumped Up during Accumulation Period

A typical 101 wrapper ILP will provide 101% Sum Assured Coverage on the total premium being paid or of the policy value (whichever is higher) throughout the policy term. The Manulife Smart Retire (II) Provides 105% of the total premium paid during MIP or policy value (whichever is higher) if the life assured dies or suffers from total and permanent disability.

If the life assured dies or suffered total and permanent disability during the accumulation period, The Manulife Smart Retire (II) will provide a bumped up coverage of based on the following formula:

Coverage bumped up during accumulation period

The targeted retirement income x 12 x pay-out period

This is regardless of the policy value after the MIP which mathematically may well be much higher than has been paid thus far especially in the initial stage of the accumulation period.

Thereafter the coverage will be reduced to account value during the target retirement age.

-

Low Policy Administrative Charges

While we acknowledge the fact that the bulk of the charges of the policy may be imposed via the cost of insurance during the accumulation years, it will nonetheless be refunded during the first 5 years of the targeted retirement pay-out period.

What impressed us is that the Manulife Smart Retire (II) has one of the lowest policy/supplementary fees for an Investment Linked plan at 0.75% p.a. throughout the policy term.

Charges exclude fund management fees, cost of insurance, early surrender fees and other partial withdrawal fees.

Welcome Bonuses: A Typical Wrapper Plan Features

Just like other Wrapper plans in the market, the Manulife Smart Retire will pay-out a welcome bonus between 2.5 – 35% depending on the amount invested each year and Minimum Investment Period selected. It may also at its discretion offer additional welcome bonuses if the plan is taken up during their promotional period.

Dividend Withdrawal at Any Point during Policy Term

A common feature of Manulife’s Investment-linked policy is the flexibility to withdraw and reinvested dividends paid out from a dividend-paying fund. The plan allows the policy owner to withdraw a minimum dividend of $40 or the dividends can be reinvested and draw out at a minimum of $500 later on

A Potential Legacy Solution

With proper planning, selection of funds and a bit of luck, the policy may not only function as a retirement solution but a potential legacy planning fit.

Disclaimer: This is an unsponsored post and the information provided has not been endorsed by Manulife. This article is for general information only and does not take into account the specific investment objectives, financial situation or needs of any particular person. We recommend that you seek the advice of a qualified financial advisory professional before making any decision to purchase an insurance or investment product. Whilst we have taken reasonable care to ensure that all information provided was obtained from reliable sources and correct at time of publishing, information may become outdated and opinions may change. We are not liable for any loss that may result from the access or use of the information herein provided.

Understand more

Once again, Moneyline.sg has done the homework. Not only we help you make an informed decision on a potential purchase, but we also work with financial planners that have access to multiple providers to provide you with objective recommendations. To get a quote and have your financial needs assessed, fill in the form below and a licensed financial planner will share how the Manulife Smart Retire II suits your retirement and legacy needs. Read our privacy policy