Building The Foundation Of Your Life Insurance Portfolio With The 3-Step #InsuranceCombo Tool

Have you ever faced the situation where you are stopped by an insurance agent on the street and he/she starts touting to you an insurance plan that isn’t suitable for your protection needs? One problem with this interaction model is that it becomes difficult for you to receive quality advice as a consumer. That’s why we are seeing a trend of consumers moving towards a Do-It-Yourself (DIY) model where consumers are looking for ways to build your own Life insurance portfolio.

Bridging The Life Insurance Portfolio Gap With Moneyline.SG #InsuranceCombo

However, building your own Life insurance portfolio can be slightly difficult for those who do not have prior knowledge about insurance. Even for those with knowledge about insurance, there are too many features within an insurance plan that makes it challenging for comparing.

This is when we noticed that there is a gap in the existing market for consumers to Do-It-Yourself (DIY) your own Life insurance portfolio and decided to do something about it.

To bridge this information gap in the market, the founders of Moneyline decided to build an #InsuranceCombo tool. This tool is meant to help consumers like you and I build the foundation of your own insurance portfolio, regardless of the level of financial savviness.

What Is The #InsuranceCombo Tool And How Can It Help You?

The #InsuranceCombo tool is an algorithm that provides you with a recommended suite of insurance plans to meet your Life insurance needs. All you need to do is to go through a simple 3-step process. Once you answer the question in each step, the algorithm will help you DIY your own insurance portfolio based on your response. And here’s how it works.

Building The Foundation Of Your Insurance Portfolio With The 3-Step #InsuranceCombo Tool

Step 1: Identify The Theme Of Protection You Need

The first step is to identify the overarching theme of protection you need. In general, there are 4 themes of protection that you will need, depending on your current life stage. These 4 themes of protection are:

The ‘Parenting Protection’ theme is designed for working parents who want to protect your dependents in the event of death, CI or TPD. The aim of ‘Parenting Protection’ is to build a secure financial future for your family with a suite of coverage for your death, CI and/or TPD.

For those who don’t have dependents to take care of, it doesn’t mean that you won’t need any protection. With the rising cost of living and ever increasing medical expenses, you might find yourself in a dire financial situation in the event of illness or disability. The ‘Working Adult Protection’ is meant to safeguard your income even in the event of illness or disability by having income replacement plans to deal with uncertainties in life.

As a parent, you want to ensure that your child gets off to the right start in life. One of the best ways to help your child achieve that is to ensure that they receive the right protection from young.

With the ‘Children Protection’ theme, you can kickstart your child’s financial risk management journey to protect them against the financial impact of major illnesses or hospitalisation that will stick with them through thick and thin. The ‘Children Protection’ theme comes with a combo of life and health policies to get your child the right protection from young.

Retirement is the time for you to enjoy the fruits of your labour after years of working. However, if you do not have the right protection in place, you can easily lose your retirement funds to severe illness or disability during your retirement years.

The aim of the ‘Retirement Protection’ theme is to let you protect your retirement fund early on with a war chest for medical expenses. With ‘Retirement Protection’, you don’t have to worry about depleting your retirement fund or worry about burdening your child with your medical fees.

Step 2: Select The Monthly Budget That You Can Afford For Protection

Once you have zoomed in on the theme of protection that you need, the next step is to select your budget. The monthly budget that you selected will be used as a rough premium guide to purchase the insurance plans for the protection theme that you have chosen (e.g. ‘Children Protection’).

So, how much budget should you allocate for the protection theme? As a rule of thumb, it is recommended for you to allocate around 5% of your monthly income for your insurance premium. However, if you feel that you need more protection, you can always choose to allocate more of your monthly income for the protection theme.

Read: How much should i spend on life insurance per month?

Step 3: Choose Your Current Age

The third step in this 3-step DIY process is to choose your current age. Your current age is an important factor in determining the combination of insurance plans to purchase for your desired theme. That’s because your current age is a reflection of the current life stage that you are in, which is a major factor of consideration when deciding how much coverage you need.

What’s Next After The 3-Step DIY Process?

Once you have completed the 3-step DIY process, Moneyline.SG algorithm will recommend an insurance portfolio for your desired protection. This insurance portfolio is based on the historical trend of insurance portfolios of a diverse group of people as well as your budget, current age and protection needs.

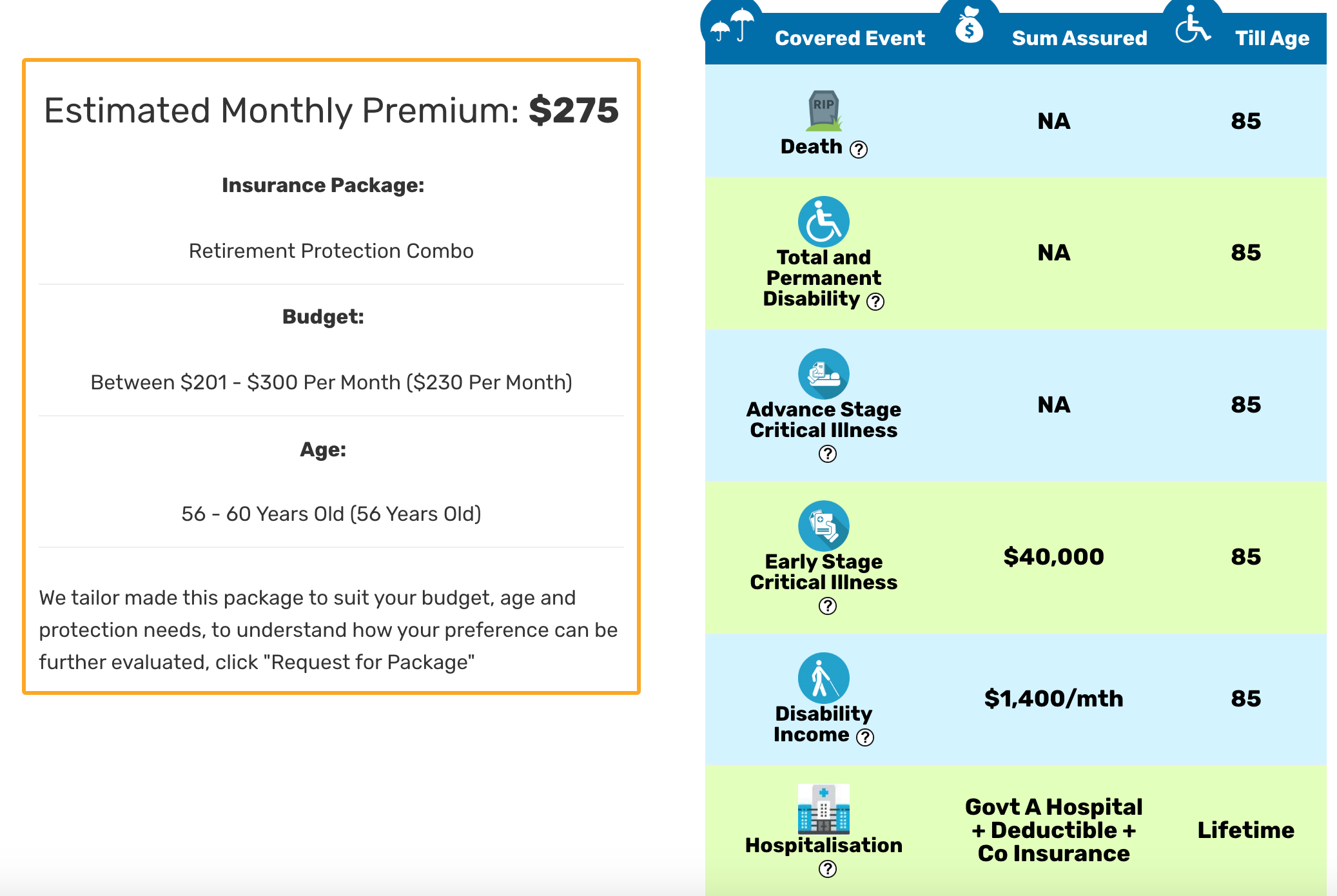

Sample of ‘Retirement Protection’ Combo

Customising The #InsuranceCombo For A More Personalised Life Insurance Portfolio

While the recommended plan from the #InsuranceCombo tool is able to provide you with a good basic coverage, it might not achieve the level of personalisation that will suit your needs. In order to get a more personalised Life insurance portfolio, you will need to enhance the recommendation with a review of your existing financial plans and life stage.

The best way to achieve this is by reaching out to Moneyline.SG and let our team of professionals do a comprehensive review for you.

During the review and conversation with you, you can share your personal worries and fears with Moneyline’s professional financial consultant. This will provide us with a better picture of the kind of protection that you are looking for and give us more insights to better identify the gaps in your insurance portfolio. We will also be able to identify areas for enhancement from the #InsuranceCombo tool to build a more customized plan for you.

Try Moneyline and start your own #InsuranceCombo here today.