8 Key Takeaways From PropertyGuru’s Q2 Singapore Property Market Report

The Singapore property market is a keen interest for every Singaporean, be it whether you are an upcoming homebuyer or existing homeowner.

In the second quarter of 2023, PropertyGuru, one of Southeast Asia’s leading property technology companies, released its comprehensive Singapore Property Market Report to shed light on the latest trends and developments in the local real estate landscape.

We read through the report to distil the key takeaways for our readers in this article.

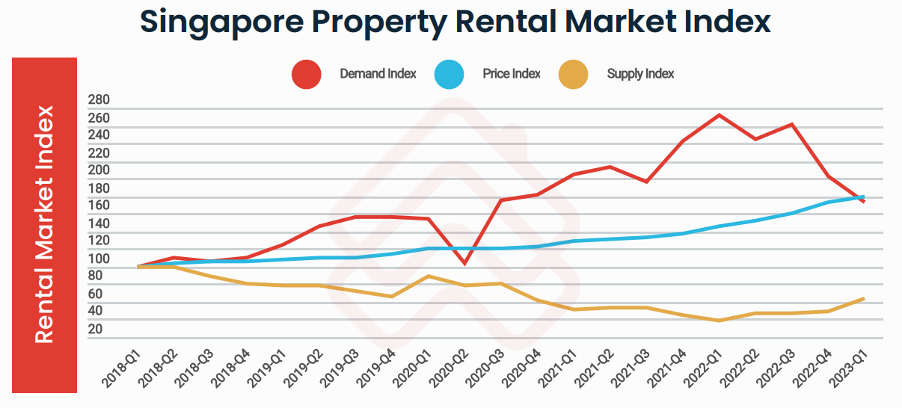

Rental Demand Is Coming Down, But Still Above Pre-Covid Levels

Source: PropertyGuru

The Singapore Property Rental Index (blue) continues to be on an upward trend. However, sharp eyed readers will notice that the uptick from Q4 2022 to Q1 2023 is much more gradual compared to other quarters. This is an indication that the pace of rental growth is showing signs of slowing down.

One potential reason for this is that demand for rental properties is declining much more rapidly. PropertyGuru’s Singapore Property Rental Demand Index (red) experienced its consecutive quarter of decline. PropertyGuru puts this number at 14% decline quarter-on-quarter.

As more condos and HDBs get completed in the coming quarters, there is a high likelihood rental demand will continue to fall as supply catches up with the demand. For now, rental demand is still above the pre-covid levels in 2019.

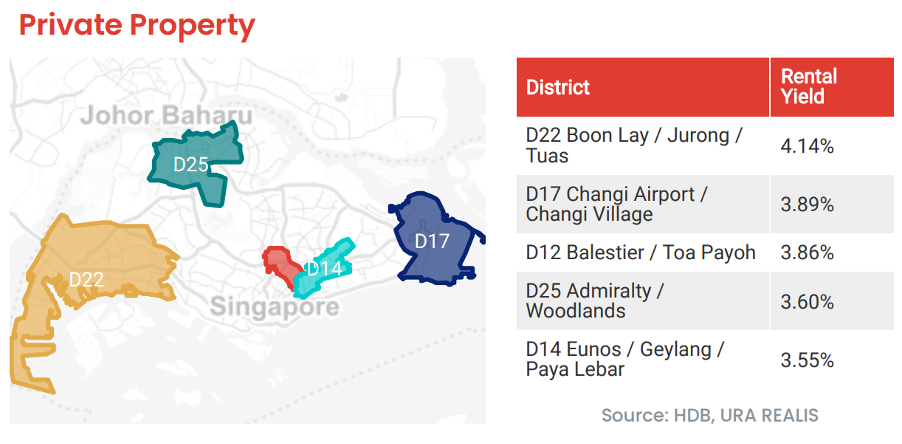

Top Performing Districts For Rental Yields (Private)

Source: PropertyGuru

In the private property market, PropertyGuru’s research found that properties in D22 and D17 were offering interestingly high yields at almost 4%. This may be bewildering for some considering that these two districts are Outside Core Region (OCR) districts. PropertyGuru attributes the good rental yield to be due to the low buy-in prices for properties in these areas.

This is a strong reminder for homebuyers that the buying price of a property is important, especially if you are aiming for a long term yield play.

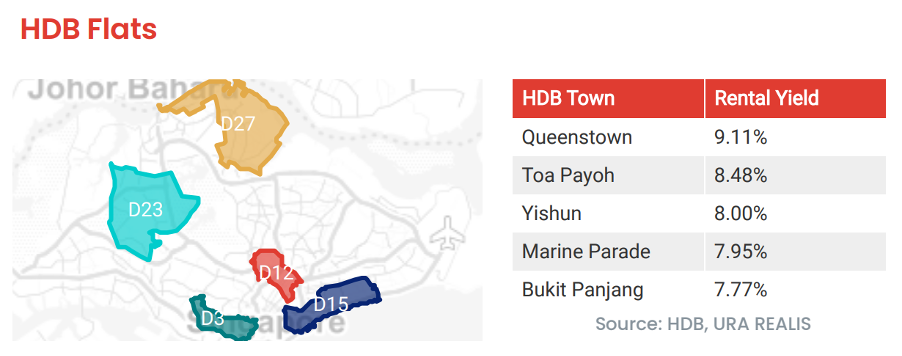

Top Performing Districts For Rental Yields (HDB)

Source: PropertyGuru

In the HDB market, the districts that are showing high rental yields would be more in line with expectations. Estates like Queenstown, Toa Payoh, and Marine Parade have traditionally been estates that have strong rental demand.

One interesting fact to point out is that rental yields on HDB is almost twice the yield on private properties. This is a combination of how strong demand is for even HDBs in good locations and how inflated the private property market is.

Another fascinating fact is that Yishun and Bukit Panjang were among the top five estates for rental yield despite not being city fringe areas. However, PropertyGuru does foresee rental yields coming down given that sellers in these two estates are eagerly selling their properties at higher asking prices.

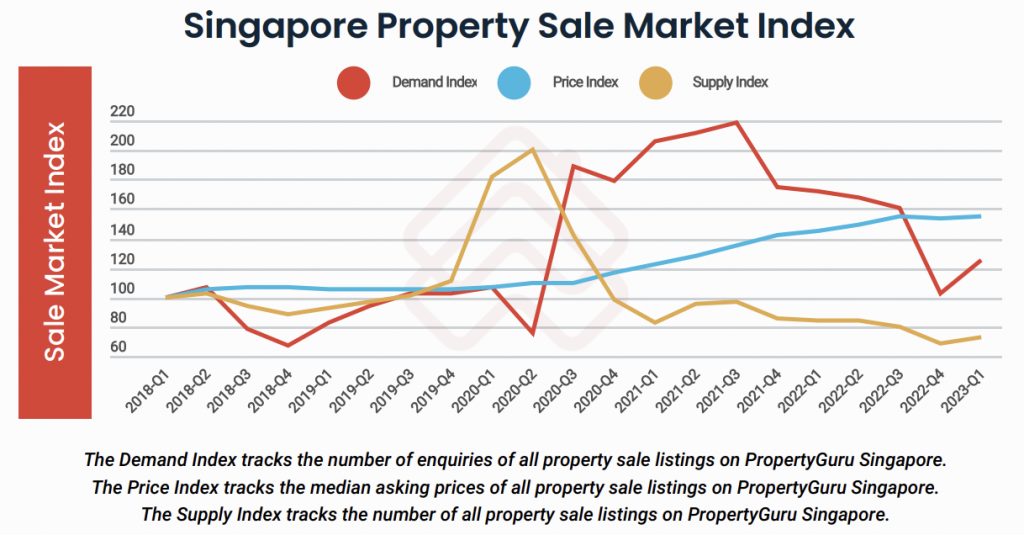

Resale Market Demand Bounced Above Pre-Covid Level

In Q4 2022, demand in the resale market saw a significant dip compared to the previous quarter. This fell all the way back to levels seen during pre-covid times. But in the most recent quarter of Q1 2023, demand respited and jumped almost 20% from Q4 2022. This was seen across the board for all types of property, from HDB to non-landed to landed properties.

Interestingly, the Property Sale Price Index (blue) continued to stay stable in the 150 range for the past three quarters. In its report, PropertyGuru foresees HDB resale prices to plateau in the second half of 2023. Given the trajectory of the Property Sale Price Index, the likelihood seems high.

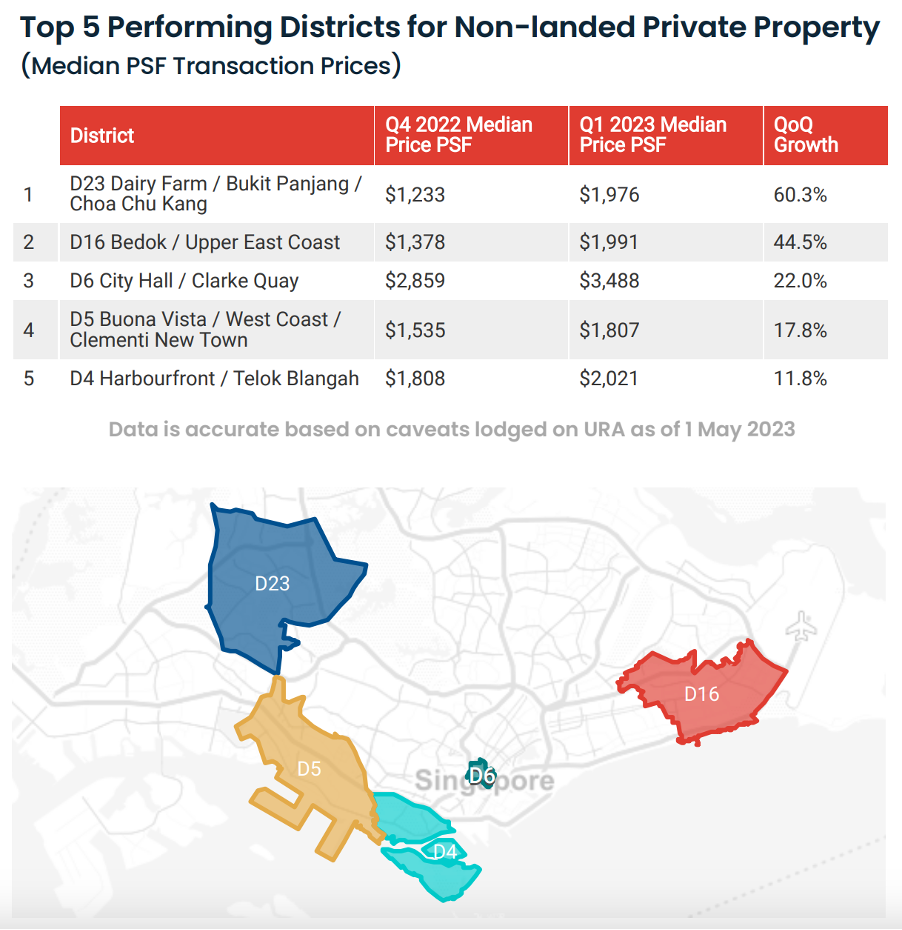

Top Performing Districts For Resale Prices (Private)

In terms of resale prices, districts that landed in the top five spot for non-landed private property were generally districts that had new launch condos. Case in point is The Botany at Dairy Farm, which drove up prices in District 23.

This seems to suggest two things:

- New launch condos are great for the neighbourhood because it helps to drive optimism and prices in the area.

- New launch condos are more expensive than existing resale condos.

New Launch Condos To Watch For

Given the uplift effect of new launch condos for the district, new launch condos are always highly anticipated among both existing homeowners and potential homebuyers.

In the coming quarters, there will be multiple new launches that are up for grabs. These new launches include:

- Tembusu Grand (D15) – Launched

- The Continuum (D15) – Launched

- The Reserve Residences (D21) – Launched

- Lentor Hills Residences (D26)

- The Myst (D23)

- Pinetree Hill Residences (D21)

- Grand Dunman (D15)

- Lake Garden Residences (D22)

- The Hill @ One-North (D5)

- The Arden (D5)

- Newport Residences (D2)

- Skywaters Residences (D2)

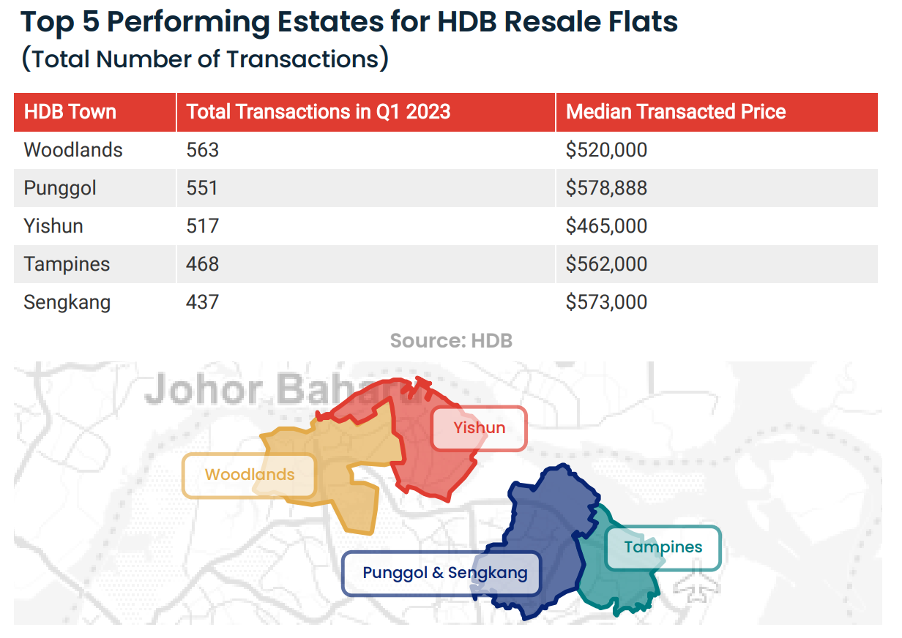

Top Performing Districts For Resale Prices (HDB)

In the resale HDB market, the top five estates were mostly in the OCR areas. Part of the reason for this is because Woodlands and Punggol had the most units that just met its 5-year Minimum Occupation Period (MOP).

This seems to suggest that there is a strong demand among homebuyers for resale HDBs with ample amount of leasehold.

In the coming two quarters this year, PropertyGuru foresee Bukit Batok joining the top five, given that it will have a sizeable volume of HDBs meeting its 5-year MOP this year.

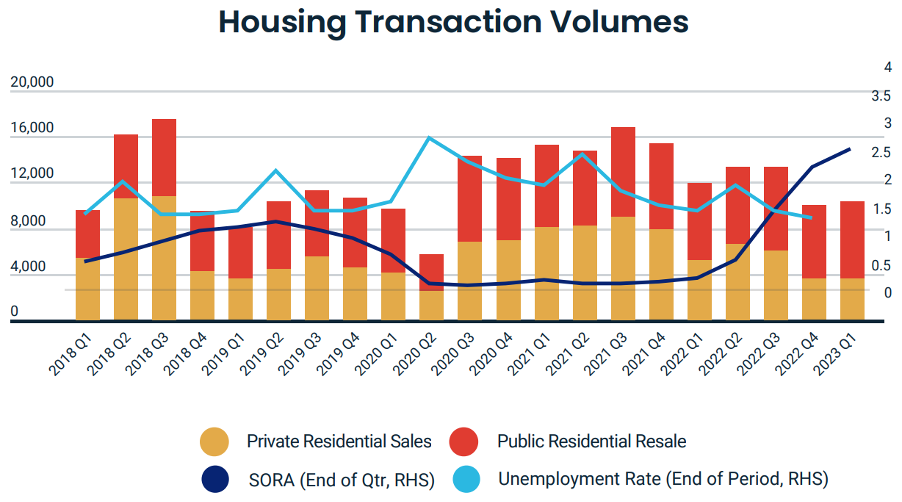

Housing Transaction Volume Going Steady Despite Rising SORA

One of the key concerns among homebuyers is the rising interest rates. In particular, the Singapore Overnight Rate Average (SORA) has been moving pretty fast in the last year. It went up almost fivefold from 0.5% to 2.5%.

But if we look at the housing transaction volume, it seems to be holding steady at around 9,000 per quarter.

It Pays To Be Mortgage Savvy As SORA Continues Its Rise

While nobody knows whether interest rate will go up or down in the coming quarters, data seems to suggest that a rising interest rate environment will continue in the near term.

Therefore, we think it is important for homebuyers to be smart about your mortgage. You will definitely want to get the best interest rate you can to keep your cost of home ownership as low as you can.

One simple way to do that is to engage a personal finance planner like Moneyline. We offer free mortgage comparison services to help you get the best interest rate available. We also help you get the paperwork done so that you don’t have to worry a thing about your mortgage while you enjoy the best interest rate deals you can.