Setting goals is the first step in achieving anything that you want. For many of us, retirement is a goal…

7 Figures That Will Convince You That You Need To Start Planning For Retirement NOW

Retirement is one of those things in life that you need to start preparing for it as early as possible. So, have you started to plan for your retirement in Singapore? If you haven’t already, it is probably because you haven’t known the facts about retiring in Singapore. So, here are 7 set of numbers that you should know to help you grasp the hard truth about retiring in Singapore. So, are you ready to hear the hard truths?

55 – Earliest Age You Can Make Partial Withdrawal From CPF

When Singaporeans are discussing the topic of retirement, the first thing that comes to mind is our CPF. But did you know that you can only make a withdrawal from your CPF savings at age 55? Not to mention, the withdrawal is only partial. You will need to keep a portion of your savings for the basic, full or enhanced retirement sum.

62 – Official Retirement Age

While 55 is the number that most Singaporeans tend to remember, the official retirement age for Singaporeans is actually 62. It is also the age where you can start to draw down your SRS.

$88,000 – CPF Minimum Sum (Basic Retirement Sum)

The basic retirement sum is the minimum amount of money you MUST keep untouched within your CPF. CPF will only allow you to make a partial withdrawal of your CPF savings up to the point where you have at least $85,500 in your CPF. The CPF minimum retirement sum increases every year and can be found from CPF website. In 2020, it is expected to increase to $90,500.

$1,379 – Basic Monthly Expense For A Singaporean

According to a recent survey done by NUS Lee Kuan Yew School of Public Policy, Singaporeans above age 65 need at least $1,379 a month to meet your basic needs. This includes household expenditure, budget for home maintenance and the occasional upgrade/repair of mobile phones. Based on the estimate of $1,379, it means that you need at least the full retirement sum savings in your CPF in order to afford such a lifestyle.

$176,000 – CPF Minimum Sum (Full Retirement Sum), $1,450 – CPF Life

The CPF minimum sum of $176,000 will translate to a monthly pay out (under the standard plan) of $1,350 – $1,450 for life. This will allow you to meet the basic monthly expense needs of a Singaporean in your 60s. However, if you are looking for the occasional holiday trip, you will need to ensure that your monthly pay out surpasses $1,450.

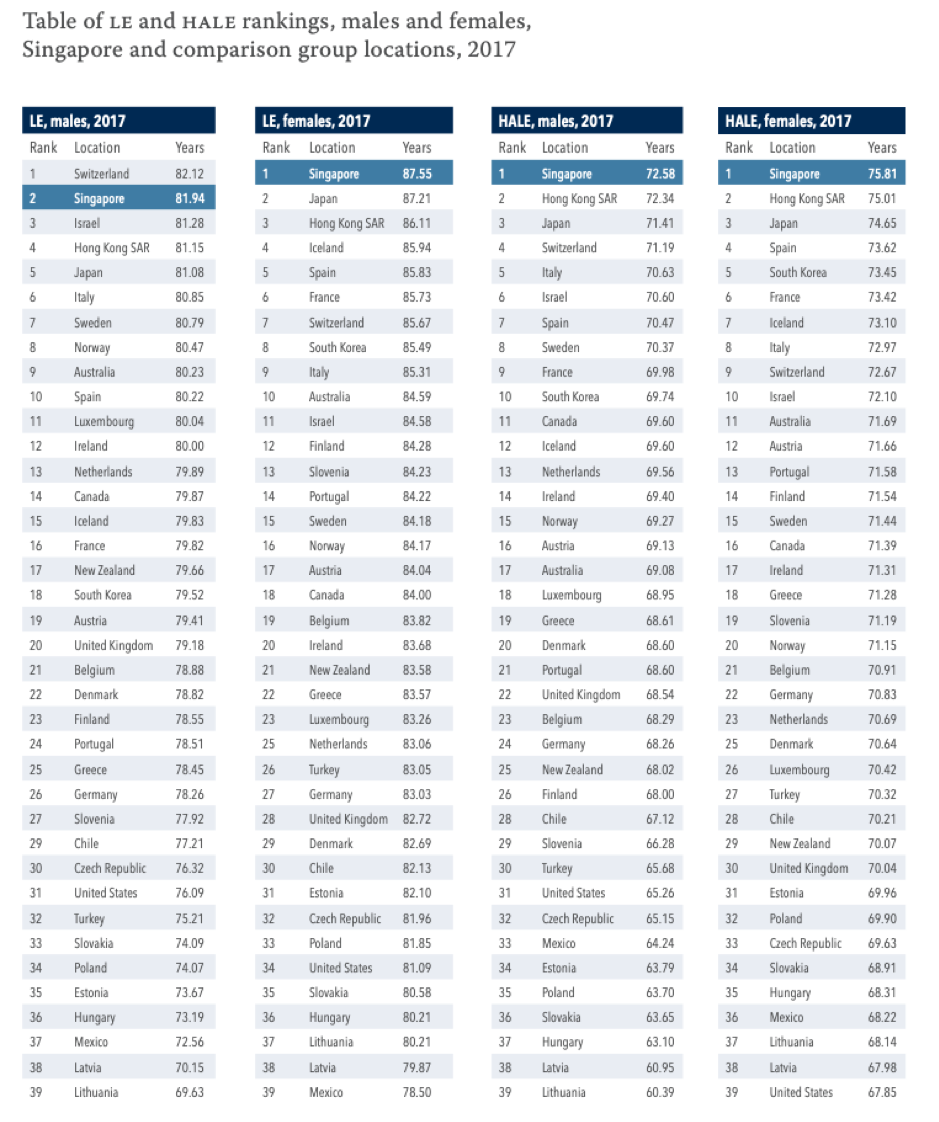

85 – Singaporean’s Average Life Expectancy

Based on the latest World Health Organization (WHO) report on life expectancy, Singapore topped the world in terms of overall life expectancy. Singaporeans live till age 84.8 on average, which is the highest in the world. This is a great improvement from the 1990s where Singapore’s life expectancy was only 74.2.

Source: WHO

10.5 – Number Of Years That Singaporeans Will Live In Poor Health

While it is good news that Singaporeans are living longer, you should also note that there has been an increase in the number of years that Singaporeans will spend in poor health. According to WHO, Singaporeans are expected to live in a healthy condition for 74.2 years (on average) with the rest being spent in poor health. It is important for you to acknowledge that and make preparations for such a situation by ensuring that you have the right health and critical illness coverage.

Check out 3 Best Retirement Plans in Singapore

Review: NTUC Income Revoretire: 4 Unique Features For Your Retirement Planning

Need Help With Your Retirement Planning?

While the hard truths about retirement might have hit you hard, there’s still a silver lining in the clouds. If you start your retirement planning today, you can still make it for a comfortable retirement lifestyle. Hit us up right below to let us help you with your retirement planning and guide you towards a comfortable retirement lifestyle.

1 Comment