6 Personal Finance Hacks For Singaporeans Who Want To Retire Early

63 is the official retirement age in Singapore, which will progressively increase to 65 by 2030. The rising cost of living, ability to own a property, and capability to retire are constantly on the back of the minds of Singaporeans.

The stubbornly high inflation for the past year worsens the problem. According to the Monetary Authority of Singapore (MAS), core inflation rate is projected to be between 3.5% to 4.5% in 2023.

In the midst of rising inflation rates, exacerbated by longevity and increasing healthcare cost, the foremost concern for most Singaporeans is the ability to retire well. Therefore, we came up with our pocket list of personal finance hacks for Singaporeans who are looking to retire early.

Personal Finance Hacks For Singaporeans Who Are Looking To Retire Early

-

Keeping track of your expenses

Create a realistic budget and track your expenses to help achieve your financial goals. By tracking your expenses, you will be able to easily identify unnecessary spending to avoid overspending. It also helps you make more conscious decisions in controlling your spending, and make adjustments to save more money. In addition, keep track of your expenses will help you avoid accumulating debt, prepare for emergencies, and unexpected expenses.

-

Realising That Mortgage Interest Rate Is Not Fixed

One of the big ticket items that Singaporeans will make in their lifetime, is purchasing a property. The rate of home ownership in Singapore is a whopping 88.9 per cent in 2021, despite being among the world’s most expensive residential property market. Prices of non-landed private residential properties rose by 4.2 to 9 per cent for the whole of 2022.

High interest rate is also affecting the demand from price sensitive homebuyers and Housing Board (HDB) upgraders, as their ability to borrow is crimped. In spite of two rounds of property cooling measures, home owners are sandwiched by rising mortgage rates and higher home prices.

The existing industry benchmark for floating mortgage rates, 3M Sora, has increased from 0.2% to 3% in 2022 and is currently at 3.21%. This could increase further in the coming months with 3M SORA showing no signs of slowing down. All of these makes owning a shelter over your head more expensive and impacts your retirement journey.

Therefore, one of the ways to give yourself more disposable income that is reduce your cost of home financing. This in turn gives you the flexibility to channel those spare cash into a retirement savings account.

Avoiding expensive houses outside of your budget is one way to reduce the cost of home ownership. In addition, make sure to keep your hoem financing cost low by leveraging on online services such as Moneyline.sg for the best interest rates. Moneyline.sg helps you to compare over 15 banks for the best home loan refinance rate in Singapore, providing the best unbiased advice for your home loan package.

-

Leverage Free Money From CPF Retirement Matching Savings Scheme

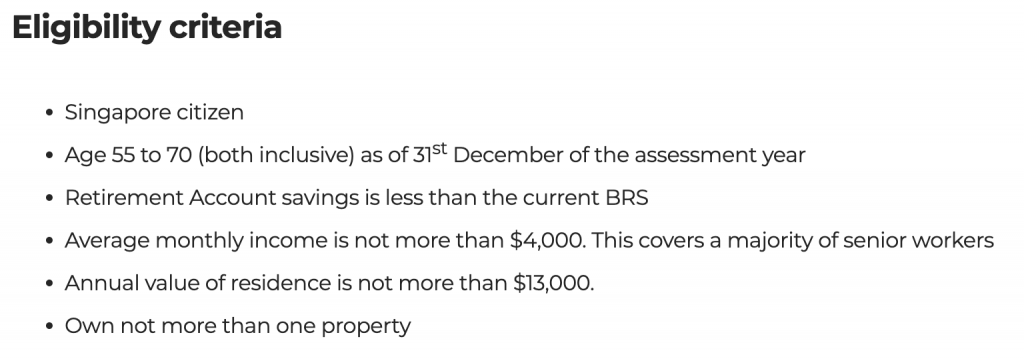

The Central Provident Fund Board (CPF) launched the Matched Retirement Savings Scheme (MRSS) in 2021 to help senior Singapore Citizens who have not reached their Basic Retirement Sum to build their retirement savings.

Under the MRSS, you can top up $600 into your own or your loved ones CPF RA. The Government will match a dollar for dollar for any top-ups received in the Retirement Account (RA) for eligible members. This means you get additional $600 (read: free money) for just contributing to your own or your loved ones retirement.

-

Enjoy CPF Top Up Tax Relief While You Save For Retirement

Another scheme that CPF offers is the CPF Top Up Tax Relief. Every year, you can make self-contribution into your own RA or Special Account (SA) of up to $8,000. In addition, you can also make up to $8,000 contribution to your loved ones CPF RA or SA.

However, here’s something to take note. The CPF Top Up Tax Relief is capped at $8,000 for both of your parents. Even if you top up $8,000 for each parent, you can only claim $8,000 in income tax relief even though you paid out $16,000 in cash.

In total, you can contribute up to $16,000 ($8,000 for self, $8,000 for your loved ones), which will qualify for the income tax relief. The $16,000 will help lower the tax bracket for your personal income tax for the year. Based on the median household monthly income of Singaporeans (~$10,000), you can save $1,840 a year in income tax just by topping up your own (and your loved ones) CPF RA or SA.

-

Don’t Let Your Money In CPF “Sit Idle” (CPF Investment Account)

If you think that’s the end of what CPF has to offer, it’s not. For more savvy investors, you can also make use of the money in your CPF Ordinary Account (OA) to invest.

Of course, don’t get us wrong. Letting your money sit in CPF OA to earn the 2.5% interest rate is great. But what if you can get something even more?

For instance, fixed deposits and short-term Singapore Government Securities (SGS) are currently offering close to 4% interest rate. That’s almost 60% higher than the 2.5% CPF OA interest rate.

There are also other investment options like investing with robo advisors or professionally managed unit trusts that can help you grow your CPF money at higher investment return.

-

Cash Is King, But Only For A Short While

The current market conditions is making everyone rethink their investment strategy. Many investors are looking to hold onto cash because cash is now king. But holding onto cash may not be the best strategy for long.

At the root of the world’s existing financial system is that money is inflationary. It is because money will devalue, therefore everyone is looking for ways to grow the money. This in turn drives economic activities.

While the world is now facing recessionary pressure, it isn’t expected to last for a long, sustained period. Thus, the flight to safety and “cash is king” mindset will only hold true for the next couple of years. But if you are thinking about retirement, you need to look beyond the ten year horizon.

High Yield Savings Account Is Where Your Cash Should Go

If you are really adamant about keeping your retirement savings as cash, there are also hacks for that. We would suggest keeping them in high yield savings account with the banks. For example, UOB is offering an effective interest rate of 5% p.a. if you use their UOB One account and bank $100,000 with them. DBS and OCBC are also offering similar high yield savings account with interest rate ~4%.

Invest When Others Are Fearful

But if you have a higher risk appetite, we think now is an opportune time to take advantage of the gloomy market sentiments to fish up great companies at a discount. Moneyline can help you to plan how to invest your retirement savings through managed fund portfolios that are personalised for your retirement needs. Simply leave your details in our form and we will arrange a session to help you with your investment planning

.