The Compounding Effect: Building Lifetime Income in SG

Welcome to our guide on the compounding effect and how it can help you build a lifetime income in Singapore. When it comes to financial success, the power of compounding cannot be underestimated. This phenomenon has the potential to exponentially grow your wealth over time, enabling you to secure a sustainable income for life. In this article, we will explore the principles of compounding effect and provide actionable strategies that can assist you in harnessing its power to create long-term financial security.

Understanding the Compounding Effect

At its core, the compounding effect is the process of generating earnings from both the initial principal and the accumulated interest or returns over time.

In other words, it is making your money work for you, allowing it to grow and multiply without requiring substantial additional effort from you. The earlier you start, the greater the potential benefits of compounding.

In Singapore, there are various avenues to leverage the compounding effect. One popular approach is investing in the stock market, where you can buy shares in well-established companies and benefit from their growth and dividend payments. Additionally, you can consider other investment vehicles such as mutual funds, exchange-traded funds (ETFs), or real estate investment trusts (REITs) to diversify your portfolio.

Harnessing the Compounding Effect for Lifetime Income

To build a lifetime income through the compounding effect, it is essential to adopt a long-term mindset and be consistent in your investment approach. Here are some practical steps you can take:

- Start Early: Time is a crucial factor in compounding effect. The earlier you begin investing, the more time your investments have to grow. Take advantage of your youth and start investing as soon as possible.

- Set Clear Goals: Define your financial goals, whether it’s saving for retirement, purchasing a home, or funding your children’s education. Having specific objectives in mind will help you stay focused and motivated.

- Diversify Your Investments: Avoid putting all your eggs in one basket by diversifying your investment portfolio. This helps reduce risk and increases the potential for long-term growth. Consider a mix of stocks, bonds, mutual funds, and other assets.

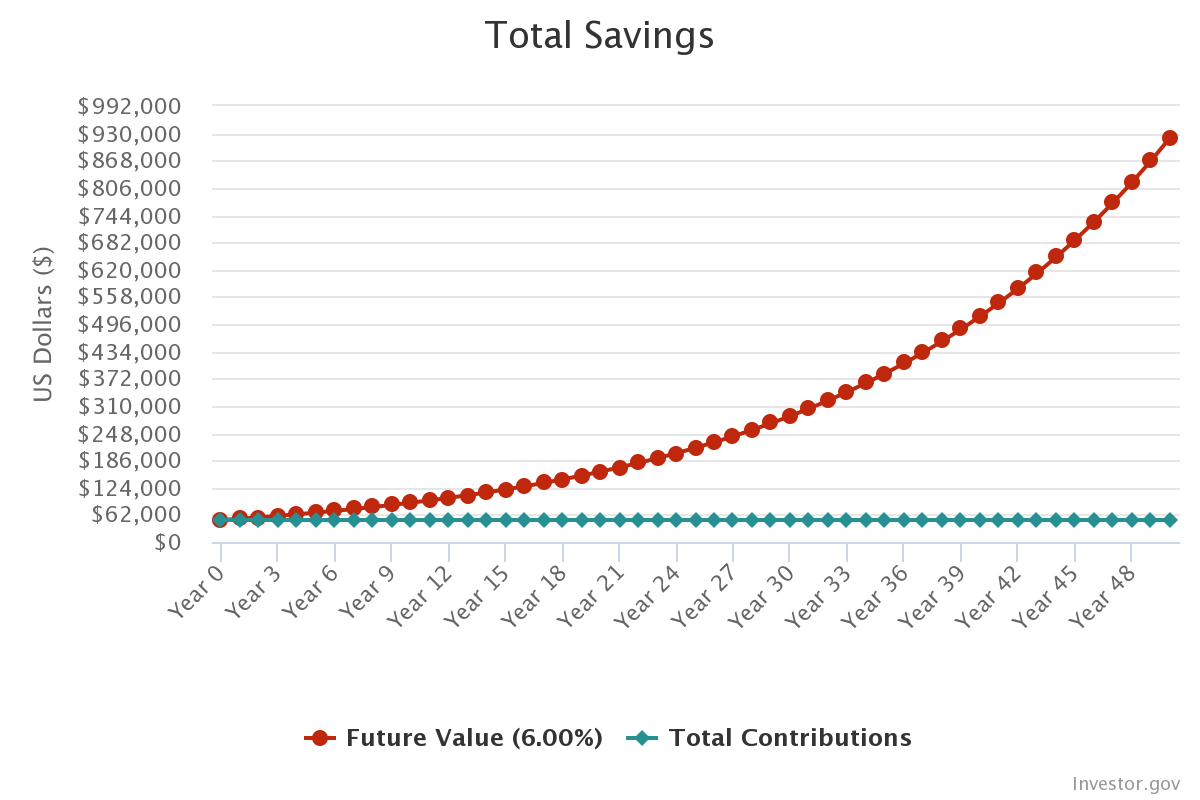

Here’s an example of the potential growth of a diversified investment portfolio over time:

| Year |

Initial Investment |

Annual Return Rate |

Total Balance |

| 10 |

$50,000 |

6% |

$89,542 |

| 20 |

$50,000 |

6% |

$160,357 |

| 30 |

$50,000 |

6% |

$287,174 |

| 40 |

$50,000 |

6% |

$514,285 |

| 50 |

$50,000 |

6% |

$921,007 |

- Reinvest Dividends and Returns: Instead of spending the dividends or returns generated by your investments, reinvest them. Reinvesting allows you to compound your earnings and accelerate the growth of your portfolio.

- Stay Consistent: Regularly contribute to your investments, even if it’s a small amount. Consistency is key in harnessing the power of compounding effect. Set up a systematic investment plan (SIP) or automatic monthly transfers to ensure regular contributions.

- Monitor and Review: Keep track of your investments and review your portfolio periodically. Evaluate the performance of your holdings and make adjustments if necessary. However, avoid making impulsive decisions based on short-term market fluctuations.

- Seek Professional Advice: If you are unsure about investment strategies or need personalized guidance, consult a financial advisor. They can help you assess your risk tolerance, develop an appropriate investment plan, and provide ongoing support.

Understanding the Power of Compound Interest

Utilizing Retirement Accounts and CPF: the Compounding Effect

In Singapore, individuals have access to various retirement accounts and schemes that can enhance the compounding effect for lifetime income.

One such program is the Central Provident Fund (CPF), which offers a range of savings, investment, and housing-related schemes.

By contributing to your CPF account, you can benefit from the power of compounding effect as your funds grow over time. CPF provides attractive interest rates, making it a valuable tool for building a retirement nest egg. You can also consider contributing to the Special Account (SA) or Retirement Account (RA), which offers higher interest rates and provide additional income in retirement.

Investing in Supplementary Retirement Schemes (SRS) is another way to boost your retirement savings. SRS allows you to make tax-deductible contributions and enjoy tax benefits. The funds invested in SRS can be used to purchase various investment instruments, leveraging the power of compounding to grow your retirement income.

Embracing a Holistic Approach to Lifetime Income: the Compounding Effect

While compounding effect plays a vital role in building a lifetime income, it’s essential to adopt a holistic approach to financial planning. Consider factors beyond investment returns, such as managing expenses, controlling debt, and protecting your income through insurance.

Create a budget that aligns with your financial goals and ensures you have sufficient savings for emergencies. Minimize unnecessary expenses and prioritize your long-term objectives. Additionally, pay off high-interest debts to free up more funds for investments.

Insurance coverage is crucial to safeguarding your financial well-being. Adequate health insurance, life insurance, and disability insurance can provide a safety net, ensuring that unexpected events do not derail your long-term financial plans.

Lastly, continuously educate yourself about personal finance and investment strategies. Stay informed about market trends, economic conditions, and regulatory changes that may impact your investments. By staying proactive and adaptable, you can make informed decisions to optimize the compounding effect and secure a lifetime income.

Takeaway: Embrace the Compounding Effect for Lifetime Income in Singapore

In Singapore, the compounding effect offers an incredible opportunity to build lifetime income and achieve financial security. By understanding and harnessing the power of compounding, you can make your money work harder for you and create a sustainable income stream. Remember, the key is to start early, diversify your investments, and remain consistent in your approach. Seek professional advice when needed, stay focused on your long-term goals, and enjoy the journey towards a financially secure future.

Ready to start building your lifetime income through the power of compounding? Contact us today for personalized guidance and support on your financial journey.