Indexed Universal Life (Indexed UL): How Are They Different from Traditional UL?

For those who are of affluent wealth and wish to receive a substantial amount of life coverage for the whole of his/her life, and at the same time enjoy the upsides of the market indices while protecting against market downturns, Indexed Universal Life (IUL) may be a great solution. In this article, we’ll help you understand what Indexed Universal Life is and how can it fit into your financial planning.

This article does not warrant a recommendation; please seek advice from a licensed financial representative.

What is Indexed Universal Life and how it works

Firstly, if you understand how a traditional UL works, it shouldn’t take much to comprehend Indexed UL. Part of IUL encompasses the Traditional UL Component.

Indexed Universal Life is a non-participating Universal life policy that allocates a portion of your premium in a fixed income account (the traditional UL has 100% into this) and a larger portion of it into an equity linked index account. These premiums paid after deducting the distribution cost may be invested and allocated as follow, 30% fixed income account and 70% index account subject to the insurer’s mandate.

Index and Fixed Account Segment

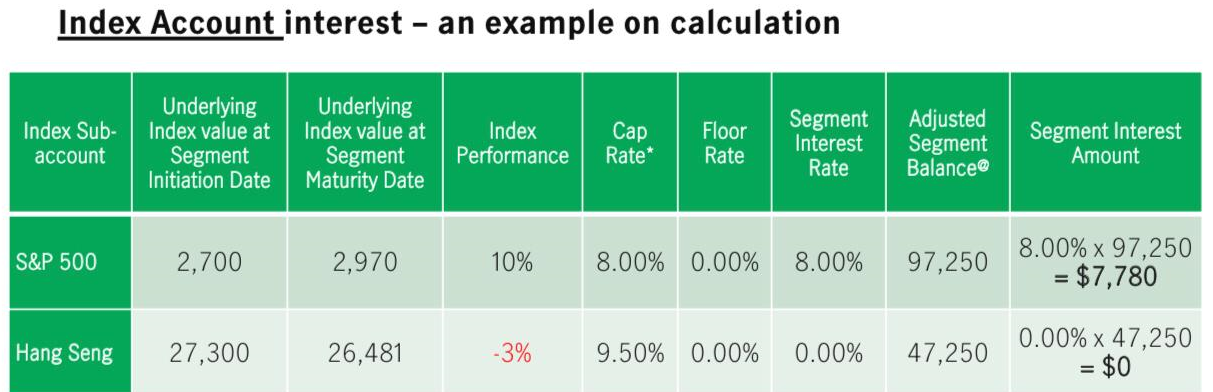

On the fixed income account segment, you will enjoy at least the guaranteed portion of the crediting rate e.g. 2% p.a. regardless of market conditions. On the Index Segment, the money stored in the index account provides you interest depending on the performance of the selected market indices e.g., in this article we use the S&P 500 and the Hang Seng Index. The index account can be sub divided into e.g. a 60% of the index component going to the S&P 500 index and 40% to the Hang Seng index. This allows for further diversification of your portfolio where you can take advantage of performance of both of these market indices. The interest accrued after the maturity every year is auto rolled into the same index account segment as proportioned by the percentage of exposure in each market.

Index Account Ceiling and Floor Return Cap on Crediting Rate

Apart from providing you with the opportunity to enjoy the performance of stock markets during upsides, the Indexed UL also provides a downside protection. E.g. the index segment of the IUL will not provide any crediting rate but protects your principal even if the stock market suffers a negative return during the year. However, a ceiling on the crediting rate is also imposed when the stock market performs favorably, e.g. the crediting rate may be capped at 8% even though the index segment achieves a 20% average return in a year.

Partial Withdrawal without Affecting Death Benefit

Unlike a typical life insurance policy, a Universal life partial withdrawal feature allows the policy holder to make withdrawal of a percentage of their policy value each year e.g. 5%, without affecting the death benefit. However, policy holders will be required to withdraw within a limit and to hold on to the policy for a certain number of years to enjoy a penalty free partial withdrawal.

Death Benefit and Full Withdrawal

Like any life insurance, the Indexed UL provides a death benefit which is payable in one lump sum upon the death of the life assured. The policyholder may also exercise the option to make full withdrawal of the policy value at any point of the policy term as long as there is cash value by surrendering the policy. Full withdrawal will effectively terminate the policy and the death benefit that goes along with it.

Single & Regular Premium and Financing Option

The Indexed UL provides flexible premiums option that can be paid in a lump sum or a regular amount. Most banks will promote the financing option whereby the policy owner can choose to pay a partial amount of the lump sum and borrow a percentage of the year 1 policy value, this can be anywhere from 50% – 90%, on a variable interest rate loan instalment.

In such scenario, the policy holder will only need to service the interest rate every year and pledge a portion of death benefit to be paid to the bank (usually the loan amount) before distributing the remaining sum assured to the beneficiaries.

However, there will be inherent risk to such practice e.g.

- The interest rates are usually variable and will result in higher instalment in a high interest rate environment.

- The cost of insurance may eat into the policy value which may subject the policy owner to not only risk the lapsation of the plan but also having to pay back the loan amount to the bank before the death of the life assured.

What is the main difference between indexed UL and traditional UL?

The main difference is that a traditional UL has most of its investment focused in bonds whereas the indexed UL primarily pegs a large portion of its returns and crediting rate to a selected portfolio of stock market indices. While this generally may mean that the traditional universal life policy gives lesser returns, it also makes this option safer, more stable and less volatile in terms of returns as compared to indexed UL. Traditional universal life policy may be better suited for someone who’s more averse to market and interest rate risk.

Depending on market performance, the Indexed Universal life policy could also prove to be cheaper than a traditional universal life policy if the market index gives out better returns which can be endowed on the premiums you need to pay.

e.g. 50 years old Female Non Smoker Standard Risk

|

Traditional Universal Life |

Indexed Universal Life |

| Coverage |

US$2,000,000 |

US$2,000,000 |

| Projected Crediting Rate |

3.85% p.a. |

5.5% p.a. |

| Lump Sum |

US$534,137 |

US$394,308 |

Pros of Index UL

- Flexible withdrawal – Policy holder may enjoy penalty free withdrawal on a percentage of their policy value on a regular basis after a certain number of years

- Good hedged against volatile market – The indexed UL provides a floor crediting rate instead of principal loss during a market downturn

- Potentially higher return – As a large proportion of the Indexed UL is pegged to selected market indices, the indexed UL provides a potentially higher crediting rate than Traditional UL

- Option of changing the life insured – The plan provides the policy holder the option to change life assured subjected to full medical underwriting and potentially revision of policy value and premium

- Cheaper than a Traditional UL – Due to the higher potential return of the Indexed UL, the premium are likely to be lower than a Traditional UL as it takes lesser amount to endow to the preferred sum assured.

Cons of Index UL

- USD – As with Traditonal UL, Indexed UL are priced and covered in US Dollar, this expose the insured and policy holder to US Dollar Exchange rate fluctuation against their own base currency

- Cost of insurance – Cost of insurance increases if the crediting rate remains unfavorable for a long term, such scenario may result in the lapsation of the UL Policy

- Ceiling cap is not guaranteed – As with the crediting rate, the cap on the crediting rate is subjected to yearly review and changes at the discretion of the insurer.

- Lack of control – Allocation are fixed and policy holders will not be able to select their investment exposures

- Expensive – As with all UL plans, it will require a higher premium to start off with, this plan is more suitable for affluent client. Most retail customer may want to look into term insurance and whole life insurance instead.

READ: 4 Best Whole Life Insurance Plan

Who is it suitable for:

In the context of Singapore, given the wide-ranging benefits of Manulife’s Indexed Universal Life policy, we think policy might be especially ideal for the emerging affluents. In general, we think this policy might not be right for those who is purely looking to invest their savings. The plan may works as a hedging instrument against market volatility for an affluent client who wish to leave a legacy for their dependents. In addition, the currency of the policy is denominated in US dollar. If you’re uncomfortable investing in the US dollar or are bearish about its future, this policy might not be for you. Also, this policy might not be ideal for those who’re seeking a lower cost death benefit protection or those who want a low to medium death benefit protection.

Once again, we have done the homework to help you understand the pros and cons of this plan so that you can decide if this policy meets your investment objectives

20 Comments