Best Investment Fund Fundsmith Equity 15.1% p.a. Returns (Nov 2023)

We are motivated to write this article on the Best Investment Fund Fundsmith Equity ever since a few of our readers came to seek our second opinion regarding a fund that some agents have been pitching to them about that is not available anywhere in any retail fund or robo-advisory platforms in Singapore.

This is not an investment/financial advice and as always when it comes to any investments, past performance does not guarantee future returns. The risk rating of Fundsmith Equity may not be suitable for you, please seek financial advice before you make any investment decisions. Readers should also understand that they may lose all their monies by investing into such products.

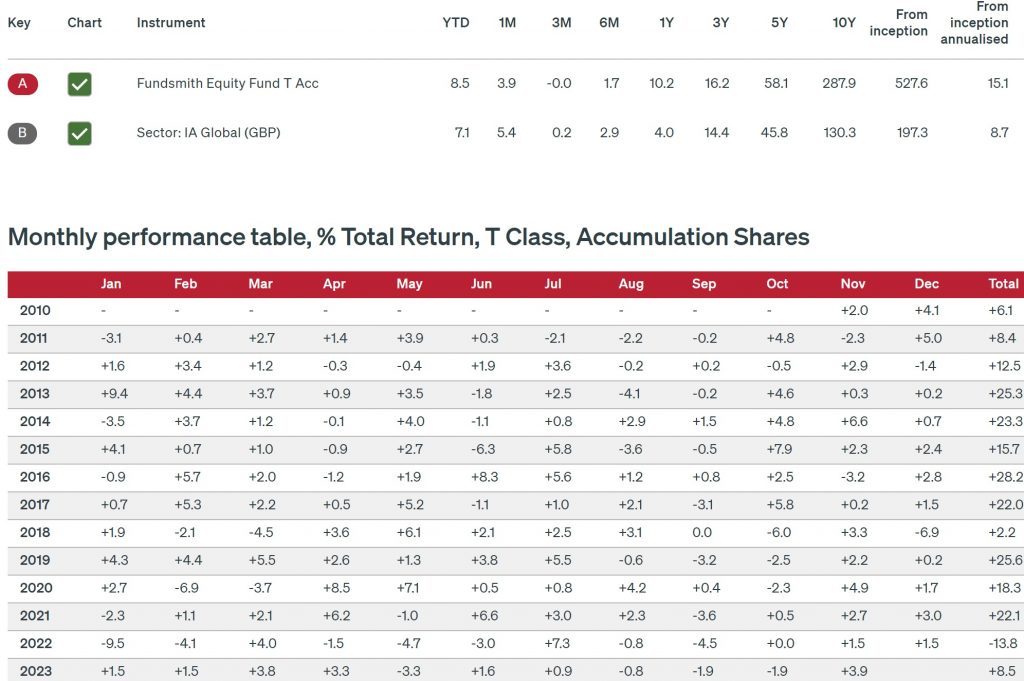

Apparently over a span of more than 13 years, except for technology focused funds, the Fundsmith Equity not only outperforms all the mutual funds available that can be bought from the various investment platforms including banks, but it has also outperformed the Standard & Poor 500 index till date. The S&P 500 of course is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The index is regarded as one of the best gauges of large-cap U.S. equities.

In November, on the 13th year of it’s existence, Fundsmith has delivered index beating year-to-date cumulative returns of 8.5%, the fund achieved a 3.9% return, driven by the equity market’s rebound and confidence in the Fed’s inflation management. The technology sector, led by Microsoft, IDEXX, and Amadeus, played a significant role in Fundsmith’s positive performance. On the flip side, consumer staples such as Diageo, McCormick, Unilever, Procter & Gamble, and Pepsico were the top detractors

Source fundsmith fact sheet as at 30th Nov 2023

*Take note that this annualised return stated is measured using it’s T Acc Share class which is available to retail investors in the UK market. The R Share class will deliver a slightly lower return due to the slightly higher annual management fees. Here are the various charges depending on the share classes. The Share Class generally available via the ILP and Platforms in Singapore is the R Class

What is Fundsmith and What makes it Work

Fundsmith is a UK fund management company founded by Terry Smith, Terry Smith is also famously being compared to famous American investor Warren Buffet so much so that he is termed as UK’s very own Warren Buffet. The company is said to be established with a foundation of being different from its peers to achieve a different result to be in line with Sir John Templeton’s axiom “If you want to have a better performance than the crowd, you must do things differently from the crowd.”

Fundsmith lives on 3 mantras on the management of their fund:

- Buy good companies.

- Don’t overpay.

- Do nothing.

According to Terry Smith, the easiest part of these mantras is the first two; buy good companies and don’t overpay because this is technically what investment managers should do. The hardest part, however, is to “do nothing” because it is common for human investors to take profit on a successful investment with the assumption that they can take this money and buy something else that has a higher growth potential. According to Smith, someone once told him that “you never get poor by taking profit, but you will ever get rich either.” Hence a buy and hold approach on good companies bought at a justifiable valuation is what Terry believes in and such approach has contributed to the fund apex status as one of the best performing global equity funds in modern history.

How to invest in Fundsmith Equity in Singapore

There are only a few ways you will be able to invest into Fundsmith Equity in Singapore, the easiest way of course is to be an accredited investor. Here are the three criteria to be an Accredited Investor in Singapore for individuals and you only need to meet one of these three:

- Annual Income in the preceding 12 months of $300,000 and above

- Net personal assets exceeding SGD2 million (or its equivalent in a foreign currency) in value, of which the net value of the investor’s primary place of residence can only contribute up to SGD1 million

- Net Financial Assets exceeding SGD1 million (or its equivalent in a foreign currency) in value

Fundsmith Equity Investment for Accredited Investors

If you are sure that you qualify as an Accredited investors with certifiable documents, you may be able to invest into Fundsmith via the IFAST or Phillip Capital platform either on your own or through a Licensed Financial Advisor that has access to both or either of these two platforms. The minimum investment can range from sgd $5,000 or $20,000 single premium or as low as $100 monthly depending on the platform.

Fundsmith Equity Investment for Retail Investors

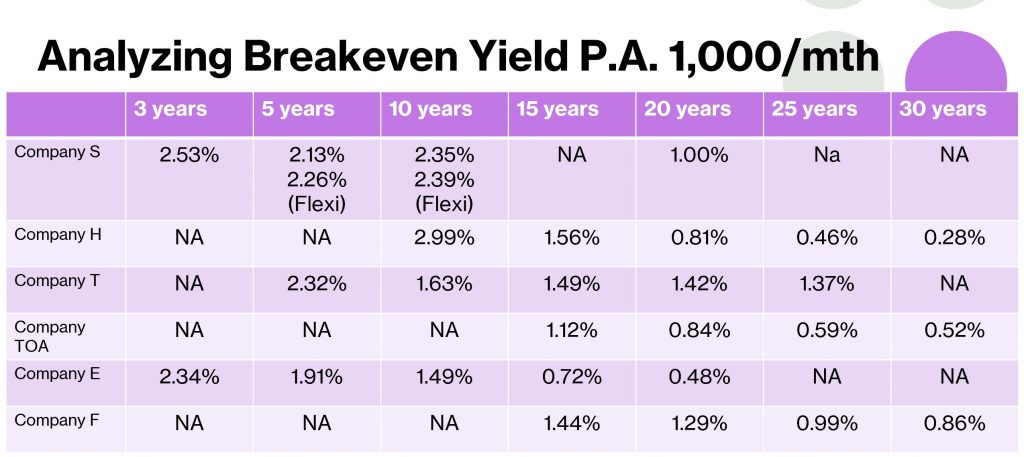

As the Fundsmith Equity Fund is a restricted foreign fund with no part of the company registered in Singapore, the fund is not available via the above platforms for retail investors. To do so however, retail investors can get exposure to Fundsmith Equity via Investment Linked Policy. Currently there are 5 companies that holds Fundsmith in their ILP Platforms, they are Tokio Marine, Singlife, Etiqa, FWD and HSBC Life. Depending on your time horizon and budget, you will be able to get exposed to this fund at a low monthly budget of $200 or a lump sum of $1,000. Cost on such platforms is typically mistakenly assume to be high but here is an example of your breakeven yield if you can hold your investments for a certain number of years from the different insurers. Due to information sensitivity, we omitted the names, but these info will be shared with you personally through enquiring with us below.

Should I Invest in Fundsmith Equity

To do so, you will have to sit down with a licensed financial advisor to first understand your needs and objective in investing. You should also have your risk profile assessed by an advisor to determine if you should even consider going 100% into such a fund. The fund by its own can be classified as moderately aggressive or aggressive depending on which platforms you are investing from. As such, it is important to know that investing in such fund can result in high volatility on your investment monies and a possible loss of principal. If you wish to find out more on how you can grow your wealth using various instrument. Do fill up your information below and Our MAS-Licensed Partner will provide you with objective advice and help you compare quotes from different providers. 100% Free & No Commitment. Retrieve your info using your Singpass app or manually fill in the form below.

7 Comments