Singlife Essential Critical Illness Diabetes Insurance & 3 Highs with 2020 CI Guidelines

Before the new definition for Critical illness comes to fruition in August 2020 Singlife has reconfigured its flagship diabetes plan to meet the needs of customers. As such Singlife Essential Critical Illness is here in compliance with the LIA 2020 definition for Critical Illness.

4 Highs Covered

If you belong to any of the following categories, this plan will consider your application

- High Sugar (Diabetes Type 2)

- High Cholesterol

- High Blood (Hypertension)

- High BMI (Obese)

How is it different from Singlife Essential Critical Illness

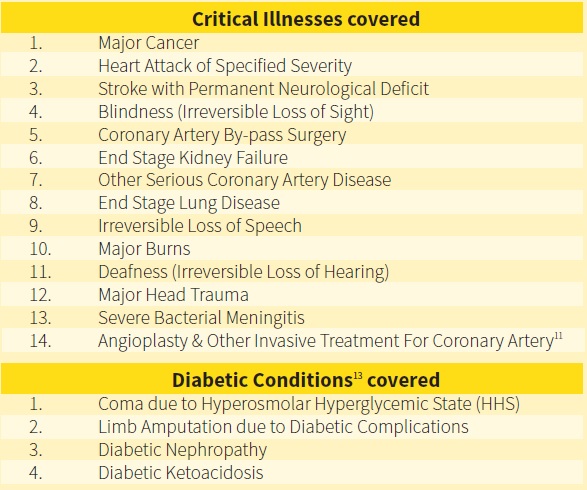

- Increased number of covered Critical Illnesses (CIs) from 11 to 14. The three new CIs covered are:

- Deafness (Irreversible Loss of Hearing)

- Major Head Trauma

- Severe Bacterial Meningitis

The CIs covered align with the new definitions and names in the LIA Critical Illness Framework 2019.

Singlife Essential Critical Illness remains a multi-protection plan which now covers 14 CIs, 4 diabetic conditions, total and permanent disability, terminal illness and death – even if you have existing health conditions (Type 2 Diabetes, Pre-diabetes, high blood pressure, high cholesterol and/or high Body Mass Index).

- Protection even with existing health conditions (Type 2 Diabetes, Pre-diabetes, high blood pressure, high cholesterol and/or high Body Mass Index)

- Coverage for Type 2 Diabetic smokers

- Answer 6 health questions to get cover – You won’t need to undergo a medical check-up if no further medical underwriting is required

- Customised premiums depending on your existing health conditions (Type 2 Diabetes, Pre-diabetes, high blood pressure, high cholesterol and/or high Body Mass Index) and you’ll know your premiums instantly provided your application doesn’t require further medical underwriting

Key Benefits of Singlife Essential Critical Illness

· What is Covered

Death/Terminal Illnesses, Total and Permanent Disability, 14 Critical Illnesses and 4 Diabetic Conditions

· Coverage Term

From 15 years to up to 85 Age Next Birthday (ANB)

· 20% SA lump-sum payout for diabetic complications

Get additional 20% of the Sum Assured upon diagnosis of any of the 4 Diabetic Conditions covered, up to S$25,000 per condition per life

· No Claim Reward

Get back 20% of your total premiums paid at the end of the policy term if no claim is made on any benefit during the policy term

source aviva.com.sg

Enhancement to Existing Singlife/Aviva MyCoreCI Plan

Coverage for additional CIs under Essential Critical Illness extended to MyCoreCI Plan

Good news! Coverage for the three new CIs will be extended to all new and existing in-force MyCoreCI Plan policies with effect from 11 May 2020 or policy issue date, whichever is later.

Moneyline.SG Deductive Reasoning

What we like

- Covers the most critical illness condition for the plan as compared to peers

- Covers Total and Permanent Disability, no other diabetes plan covers TPD

- 20% Cashback if no claims made

- Flexible coverage term from 15 years to age 85

- Covers Smoker

- A Cheaper alternative for Common Ci Coverage for healthy individuals

What we don’t

- Declined for other diabetic condition e.g. Type 1 Diabetes

- Premiums can be very expensive or policy may be declined when assured has extreme adverse readings for 4 highs

- No option to adjust Sum Assured payout on Death, Disability & CI coverage, will have to follow the basic sum assured.

- Not eligible if you are diagnosed with Type 2 diabetes before age 25

What do you do next?

Check out the Premium Table Or Get customised quotes for Singlife Essential Critical Illness

A Licensed Planner will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All quotations done is solely based on your individual needs upon verifications.

3 Comments